Introduction

The Base Rate Fallacy, also known as base rate neglect or base rate bias, is a common cognitive bias that occurs when people ignore or underestimate the base rate of a particular event when making decisions. This fallacy is a fundamental concept in fields such as psychology, statistics, and decision-making theory.

In essence, the Base Rate Fallacy is about the tendency to focus on specific information and ignore generic information. For example, if a person hears about a car accident, they might immediately think that driving is dangerous. However, they’re neglecting the base rate – the fact that millions of people drive every day without any accidents.

The term ‘base rate’ refers to the basic or inherent rate of occurrence of an event. In the context of the Base Rate Fallacy, it refers to the overall likelihood of an event happening, irrespective of any specific circumstances.

Understanding the Base Rate Fallacy is crucial because it helps us recognize how our perceptions and decisions can be skewed by specific information, leading us to make inaccurate judgments or predictions. It’s a concept that has significant implications in various fields, from psychology and economics to data science and artificial intelligence.

In the following sections, we will delve deeper into the concept of Base Rate Fallacy, explore its implications in different fields, and look at some real-world examples. Stay tuned to understand why this cognitive bias is so important and how it affects our daily decision-making process.

We have created a detailed Blog on 125 Most common biases and fallacies. Read here

Academic Definition of Base Rate Fallacy

“Evidential Impact of Base Rates,” they define the base rate fallacy as “In making judgments under uncertainty, people do not appear to follow the rule of Bayesian inference. Specifically, they underutilize prior probabilities (base rates) and often appear to ignore them altogether.”

Tversky, A., & Kahneman, D. (1982)

“The base-rate fallacy is a tendency to ignore base rates in favor of individuating information (information about a specific case), rather than integrating the two.”

Barbey, A. K., & Sloman, S. A. (2007)

Simply psychology defines base rate fallacy as –

“The base rate fallacy is a tendency to ignore base rates in favor of, or give too much weight to, specific information. This can lead to inaccurate judgments or decisions.” Source

We have created a detailed Blog on 125 Most common biases and fallacies. Read here

Historical Context of Base Rate Fallacy

The concept of the Base Rate Fallacy has its roots in the field of probability theory and statistics, but it gained significant attention in the realm of cognitive psychology in the latter half of the 20th century.

The term “base rate” refers to the underlying probability of an event, and the concept of the Base Rate Fallacy emerged as researchers began to study how people make decisions under conditions of uncertainty.

The Base Rate Fallacy was first formally identified and named by psychologists Daniel Kahneman and Amos Tversky in the 1970s and 1980s. Their work in the field of cognitive biases and heuristics revolutionized our understanding of human decision-making processes.

In a series of experiments, Kahneman and Tversky demonstrated that when given specific, individuating information (information about a specific case) and base rate information (general information), people tend to ignore or underutilize the base rate in favor of the individuating information. This tendency to disregard the base rate when other information is available is what they termed the Base Rate Fallacy.

Their seminal paper, “Evidential Impact of Base Rates,” published in 1982, laid the groundwork for understanding this cognitive bias. In this paper, they provided experimental evidence for the Base Rate Fallacy and discussed its implications for our understanding of human judgment and decision-making.

Since then, the Base Rate Fallacy has been a topic of extensive research in various fields, including psychology, economics, law, and artificial intelligence. Researchers have explored its impact on a range of decisions, from clinical diagnoses to legal judgments to financial decisions.

It’s important to note that while the Base Rate Fallacy is a common cognitive bias, it’s not universal. Some research has shown that under certain conditions, people can use base rate information appropriately. Understanding when and why people fall prey to the Base Rate Fallacy continues to be a topic of ongoing research.

We have created a detailed Blog on 125 Most common biases and fallacies. Read here

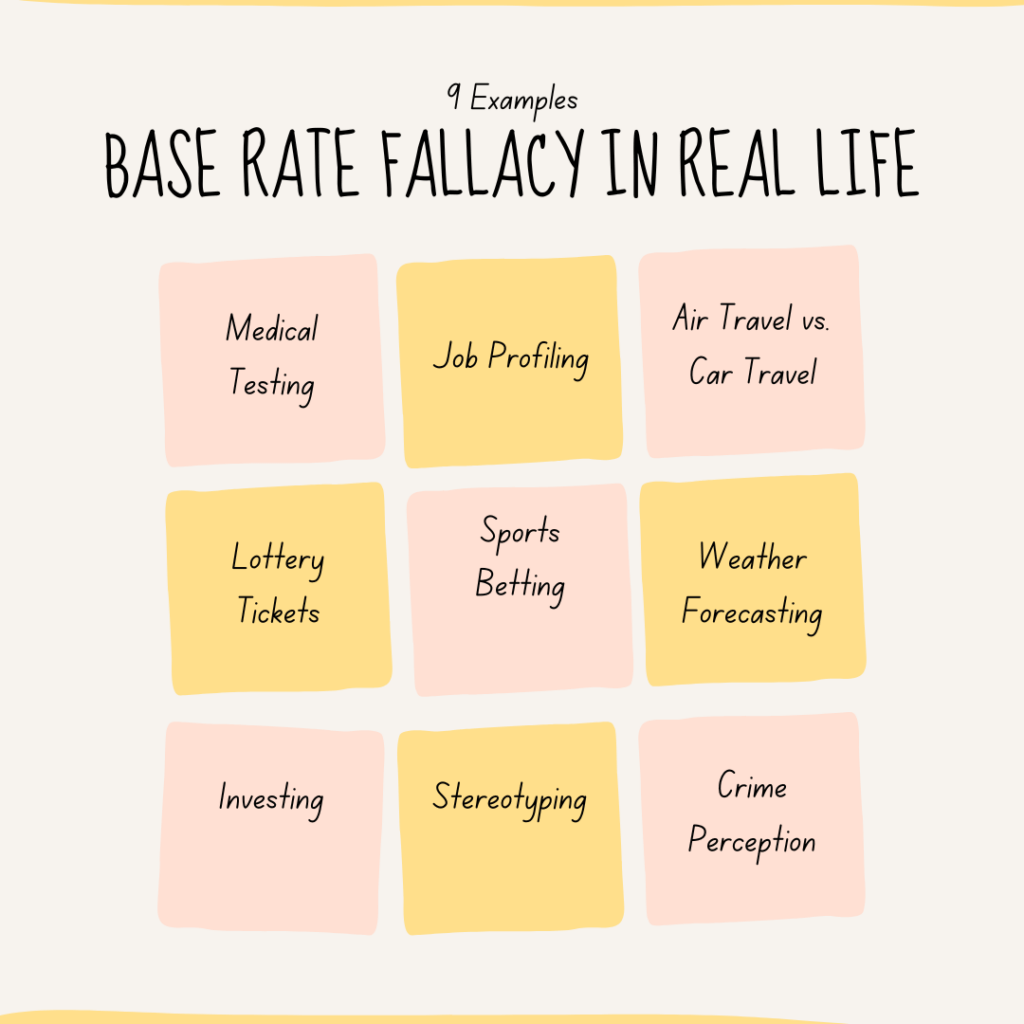

9 Examples of Base Rate Fallacy in Real Life

Medical Testing: Imagine a medical test for a disease that is 95% accurate, meaning if you have the disease, it will detect it 95% of the time, and if you don’t have the disease, it will be correct 95% of the time. Now, let’s say the disease is rare, and only 1 in 1,000 people have it. If you test positive, you might think you’re likely to have the disease, but in fact, the odds are still quite low. This is because the base rate of the disease (1 in 1,000) is being ignored in favor of the test’s accuracy rate.

Job Profiling: Suppose you’re a hiring manager looking for a software engineer. You might be inclined to favor candidates who graduated from top-tier universities, thinking that this makes them more likely to be skilled engineers. However, this could be a base rate fallacy if the overall proportion of skilled engineers is high, even among those who didn’t attend top-tier universities. By focusing too much on the specific information (the university), you might be neglecting the base rate (the overall likelihood of finding a skilled engineer).

Air Travel vs. Car Travel: Many people are afraid of flying and feel safer driving, even though statistically, air travel is much safer than car travel. This is a base rate fallacy because the fear of flying is often based on high-profile plane crashes, while the base rate of safety (the fact that the vast majority of flights land safely) is being ignored.

Lottery Tickets: When people buy lottery tickets, they often think they have a reasonable chance of winning because they focus on the stories of the few people who have won, rather than the base rate, which is that the vast majority of people who buy lottery tickets do not win.

Sports Betting: Imagine you’re betting on a basketball game. You know that the star player of a team is injured, so you immediately assume that the team is more likely to lose. However, this could be a base rate fallacy if the team has a strong track record of winning games even when their star player is out. By focusing too much on the specific information (the star player’s injury), you might be neglecting the base rate (the overall likelihood of the team winning).

Weather Forecasting: Suppose a weather forecast says there’s a 70% chance of rain, so you decide to cancel your outdoor plans. However, you live in a region where it rarely rains. This could be a base rate fallacy because you’re focusing on the specific forecast without considering the base rate of rainfall in your region.

Investing: An investor might hear about a company’s recent poor quarterly report and decide to sell their shares, fearing that the company is doing badly. However, if the company has a strong track record of profitability, this could be a base rate fallacy. The investor is focusing on the recent negative report, neglecting the base rate of the company’s overall performance.

Stereotyping: Stereotypes are often examples of the base rate fallacy. For instance, if you meet a person from a particular country and assume they have certain characteristics based on their nationality, you’re neglecting the base rate, which is that individuals vary greatly within any group.

Crime Perception: If a neighborhood experiences a high-profile crime, people might suddenly perceive the area as dangerous, even if the overall crime rate is low. This is a base rate fallacy because the focus is on a single event, rather than the base rate of crime in the area.

We have created a detailed Blog on 125 Most common biases and fallacies. Read here

Base rate fallacy psychology

The Base Rate Fallacy is a significant concept in psychology, particularly in the field of cognitive psychology and decision-making. It refers to the cognitive bias where people tend to ignore or undervalue the base rate of a particular event when making decisions and instead focus on specific, individuating information.

Clinical Psychology: In clinical psychology, practitioners often have to make diagnoses based on probabilities. For instance, if a particular symptom is common in a rare disease, a clinician might overestimate the likelihood of that disease in a patient displaying that symptom, neglecting the base rate of the disease. This is a classic example of the base rate fallacy.

Social Psychology: In social psychology, the base rate fallacy can be seen in how people form stereotypes or make judgments about groups of people. For example, if a person believes that a particular group is more likely to engage in certain behaviors based on a few high-profile examples, they’re neglecting the base rate of those behaviors across all groups.

Cognitive Psychology: Cognitive psychologists study the base rate fallacy as part of their exploration of heuristics and biases in human decision-making. The base rate fallacy is a prime example of how people’s intuitive decision-making processes can lead them astray, causing them to make judgments that are statistically less likely to be correct.

Developmental Psychology: Studies have shown that the tendency to commit the base rate fallacy can develop at a young age. Children, like adults, can focus on vivid or specific information at the expense of more general statistical information.

We have created a detailed Blog on 125 Most common biases and fallacies. Read here

Base rate fallacy in decision making

The Base Rate Fallacy plays a significant role in decision-making processes across various fields. It refers to the cognitive bias where people tend to ignore or undervalue the base rate (the general or overall rate of occurrence) of a particular event when making decisions and instead focus on specific, individuating information.

Here is how it impacts decision making

Medical Decision-Making: In healthcare, doctors and other medical professionals often have to make decisions based on probabilities. For instance, if a particular symptom is common in a rare disease, a doctor might overestimate the likelihood of that disease in a patient displaying that symptom, neglecting the base rate of the disease. This can lead to misdiagnosis and inappropriate treatment.

Financial Decision-Making: In finance, investors might focus on recent trends or specific news about a company while ignoring the base rate of market performance or the company’s long-term track record. This can lead to poor investment decisions.

Legal Decision-Making: In the legal field, jurors might focus on specific details of a case while neglecting the base rate of certain types of crimes or behaviors. This can lead to biased judgments.

Business Decision-Making: In business, managers might make decisions based on recent trends or specific events while neglecting the base rate of overall business performance or industry trends. This can lead to strategic errors.

Personal Decision-Making: On a personal level, individuals might make decisions based on specific, vivid information while neglecting the base rate. For instance, someone might choose not to fly because of a recent plane crash they heard about, neglecting the base rate that air travel is generally safer than car travel.

Base rate fallacy in statistics

The Base Rate Fallacy, also known as Base Rate Neglect, is a common error in statistics and probability. It occurs when the base rate (the overall or general rate of occurrence) of an event is ignored or undervalued in favor of specific information when making inferences.

Here’s how it impacts statistical reasoning:

Probability Misjudgment: The base rate fallacy often leads to incorrect probability judgments. For example, if a test for a disease is 99% accurate, and a person tests positive, one might think that person almost certainly has the disease. However, if the disease is rare (say, 1 in 10,000 people have it), the probability that a person who tested positive actually has the disease is surprisingly low due to the base rate of the disease.

Sampling Bias: Base rate neglect can also lead to sampling bias. If a researcher focuses too much on specific characteristics of a sample and ignores the base rate of those characteristics in the population, the results of the study may be skewed.

Predictive Modeling: In predictive modeling, neglecting the base rate can lead to inaccurate predictions. For instance, if a model is trained mostly on positive cases, it might perform poorly in predicting negative cases, especially if negative cases are the majority in the real world (high base rate).

Data Analysis: In data analysis, base rate neglect can lead to misinterpretation of results. For example, if an analyst focuses too much on the specific results of an experiment and ignores the base rate of those results in similar experiments, they might draw incorrect conclusions.

We have created a detailed Blog on 125 Most common biases and fallacies. Read here

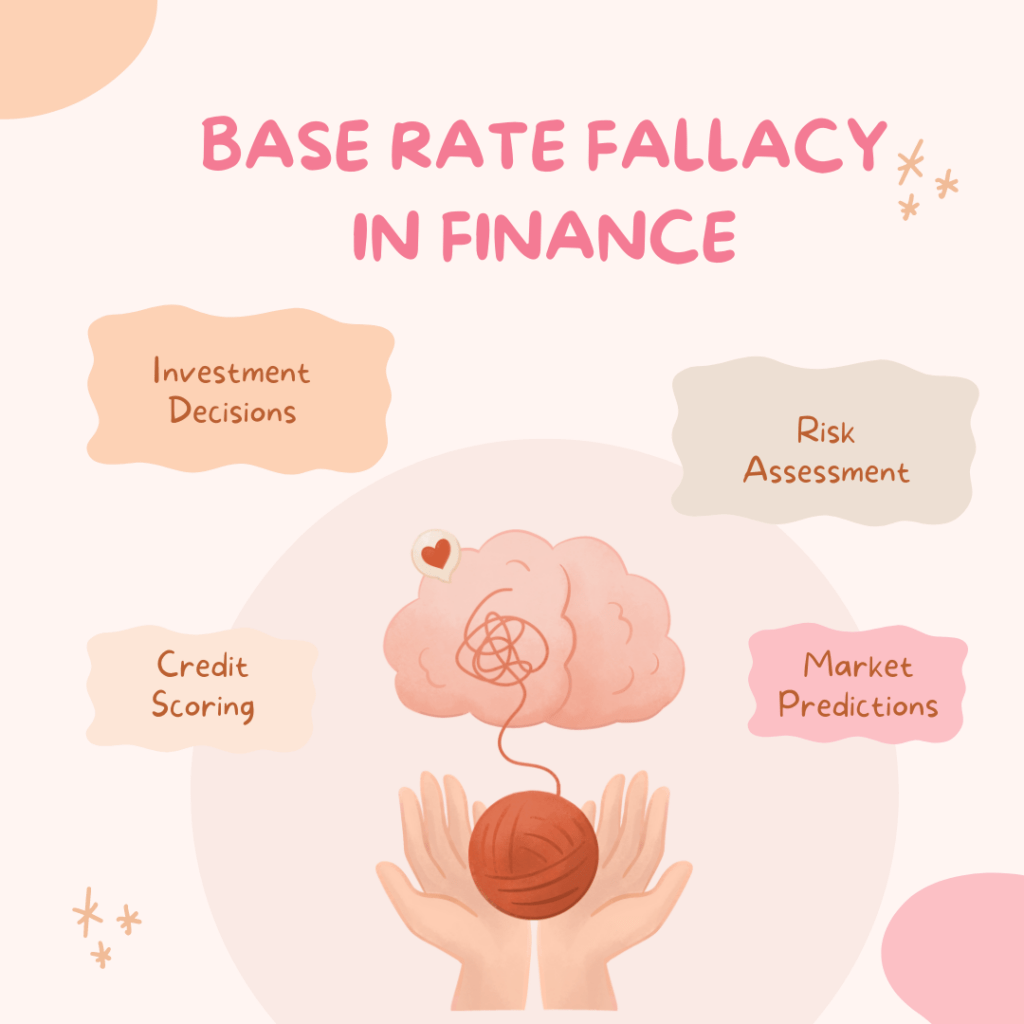

Base rate fallacy in finance

The Base Rate Fallacy, also known as Base Rate Neglect, is a cognitive bias that can significantly impact financial decision-making. It occurs when the base rate (the overall or general rate of occurrence) of an event is ignored or undervalued in favor of specific information.

Here’s how it impacts financial reasoning:

Investment Decisions: Investors might focus on recent trends or specific news about a company while ignoring the base rate of market performance or the company’s long-term track record. For example, if a company’s stock has recently surged due to a positive earnings report, an investor might be tempted to buy the stock, neglecting the base rate information such as the company’s average growth rate or the overall market conditions. This can lead to poor investment decisions.

Risk Assessment: In risk assessment, the base rate fallacy can lead to an overestimation or underestimation of risk. For instance, if a type of financial crisis has occurred recently, people might overestimate the likelihood of another one happening soon, neglecting the base rate of such crises.

Credit Scoring: In credit scoring, lenders might focus too much on specific information about a borrower (such as a recent default) and neglect the base rate of defaults among all borrowers. This could lead to an overestimation of the default risk.

Market Predictions: Market analysts might focus on specific trends or events and neglect the base rate of market movements, leading to inaccurate market predictions.

We have created a detailed Blog on 125 Most common biases and fallacies. Read here

Base rate fallacy in data science

Data Analysis: In data analysis, base rate neglect can lead to misinterpretation of results. For example, if an analyst focuses too much on the specific results of an experiment and ignores the base rate of those results in similar experiments, they might draw incorrect conclusions.

Machine Learning: In machine learning, the base rate fallacy can lead to models that perform poorly on real-world data. If the base rate of a particular class in the training data is not representative of the base rate in the real world, the model may be biased towards predicting the class that was overrepresented in the training data.

Base rate fallacy in behavioral economics

The Base Rate Fallacy is a significant concept in behavioral economics, a field that combines insights from psychology and economics to explain human decision-making. It refers to the cognitive bias where people tend to ignore or undervalue the base rate (the general or overall rate of occurrence) of a particular event when making decisions and instead focus on specific, individuating information.

Here’s how it impacts behavioral economics:

Consumer Behavior: Consumers often commit the base rate fallacy when making purchasing decisions. For example, they might overestimate the likelihood of winning a lottery or a sweepstakes because they focus on the few individuals who have won, neglecting the base rate, which is that the vast majority of participants do not win.

Financial Decision-Making: Investors might focus on recent trends or specific news about a company while ignoring the base rate of market performance or the company’s long-term track record. This can lead to poor investment decisions, such as buying stocks at a high price during a market bubble or selling them at a low price during a market crash.

Risk Perception: People often overestimate the likelihood of dramatic and memorable events, such as plane crashes or terrorist attacks, and underestimate the likelihood of common events, such as car accidents or heart disease. This can lead to suboptimal decisions, such as overpaying for insurance against unlikely events and underinvesting in prevention and protection against likely risks.

Case Studies

Insurance Decisions: A study by Kunreuther et al. (2001) found that homeowners in flood-prone areas often neglect the base rate of floods when deciding whether to buy flood insurance. They are more likely to buy insurance after experiencing a flood, even though the probability of a flood occurring does not increase after a flood has occurred.

Stock Market Investing: Barberis, Shleifer, and Vishny (1998) proposed a model of stock market investing where investors commit the base rate fallacy. They found that investors tend to overreact to a series of good or bad news about a company because they focus on the streak of good or bad news and neglect the base rate of the company’s overall performance.

Understanding the base rate fallacy can help behavioral economists design interventions, such as nudges, to help people make better decisions in various economic situations

We have created a detailed Blog on 125 Most common biases and fallacies. Read here

Base rate fallacy and cognitive bias

The Base Rate Fallacy, also known as Base Rate Neglect, is a cognitive bias that occurs when people ignore or undervalue the base rate (the general or overall rate of occurrence) of a particular event when making decisions and instead focus on specific, individuating information.

Here’s how it relates to cognitive bias:

Representativeness Heuristic: The Base Rate Fallacy is often associated with the representativeness heuristic, another cognitive bias where people judge probabilities based on the degree to which one event or scenario is similar to another. If a situation seems similar to a prototypical case, people tend to ignore base rate information and judge the situation based on the surface similarities.

Confirmation Bias: The Base Rate Fallacy can also be linked to confirmation bias, where people pay more attention to information that confirms their existing beliefs and ignore information that contradicts them. If the specific information aligns with their beliefs, they might ignore the base rate.

Availability Heuristic: The Base Rate Fallacy can be influenced by the availability heuristic, where people estimate the probability of an event based on how easily examples come to mind. If specific, vivid examples are more readily available in memory, people might ignore the base rate.

Base rate fallacy and Bayesian reasoning

The Base Rate Fallacy is closely related to Bayesian reasoning, a method of statistical inference that updates the probability for a hypothesis as more evidence or information becomes available. Bayesian reasoning is named after Thomas Bayes, an 18th-century mathematician and theologian.

In Bayesian reasoning, the base rate of an event (prior probability) is updated with new evidence to produce a revised probability (posterior probability). The Base Rate Fallacy occurs when the base rate (prior probability) is ignored or undervalued when updating to the posterior probability.

Here’s how it relates to Bayesian reasoning:

Updating Beliefs: Bayesian reasoning is all about correctly updating beliefs in the light of new evidence. The Base Rate Fallacy often occurs when people fail to correctly update their beliefs based on new evidence, often by neglecting the base rate.

Prior and Posterior Probability: In Bayesian terms, the base rate is equivalent to the prior probability. The Base Rate Fallacy occurs when this prior probability is neglected when calculating the posterior probability (the updated belief after considering new evidence).

Bayes’ Theorem: Bayes’ theorem provides a mathematical way to update probabilities based on new evidence. The Base Rate Fallacy can be seen as a failure to correctly apply Bayes’ theorem, by neglecting the base rate when updating probabilities.

For example, consider a medical test for a rare disease that affects 1 in every 10,000 people. The test is 99% accurate. If a person tests positive, you might think they almost certainly have the disease. But using Bayesian reasoning, taking into account the base rate of the disease, the probability that a person who tested positive actually has the disease is surprisingly low.

Understanding the Base Rate Fallacy can help improve Bayesian reasoning by reminding us to always consider the base rate when updating our beliefs in the light of new evidence.

We have created a detailed Blog on 125 Most common biases and fallacies. Read here

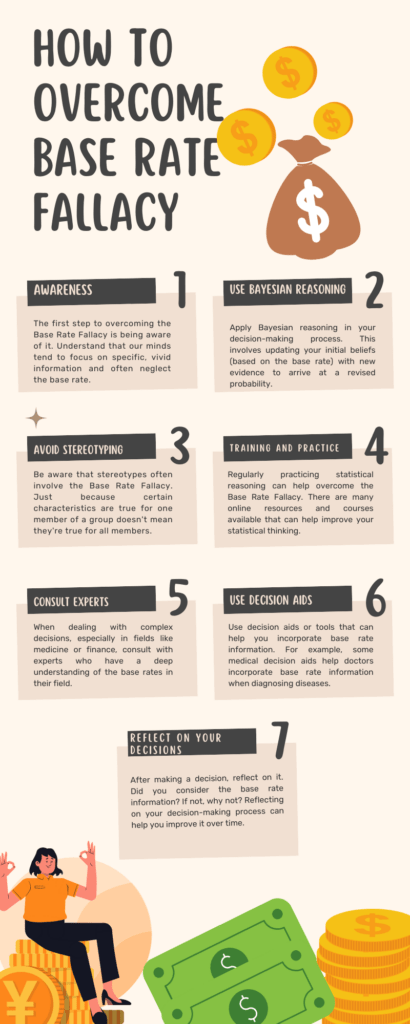

How to Overcome Base rate Fallacy

Awareness

The first step to overcoming the Base Rate Fallacy is being aware of it. Understand that our minds tend to focus on specific, vivid information and often neglect the base rate.

Seek Out Base Rate Information: Whenever you’re making a decision or judgment, actively seek out the base rate information. This could involve doing some research to find out the overall rate of occurrence of an event.

Use Bayesian Reasoning

Apply Bayesian reasoning in your decision-making process. This involves updating your initial beliefs (based on the base rate) with new evidence to arrive at a revised probability.

Avoid Stereotyping

Be aware that stereotypes often involve the Base Rate Fallacy. Just because certain characteristics are true for one member of a group doesn’t mean they’re true for all members.

Training and Practice

Regularly practicing statistical reasoning can help overcome the Base Rate Fallacy. There are many online resources and courses available that can help improve your statistical thinking.

Consult Experts

When dealing with complex decisions, especially in fields like medicine or finance, consult with experts who have a deep understanding of the base rates in their field.

Use Decision Aids

Use decision aids or tools that can help you incorporate base rate information. For example, some medical decision aids help doctors incorporate base rate information when diagnosing diseases.

Reflect on Your Decisions

After making a decision, reflect on it. Did you consider the base rate information? If not, why not? Reflecting on your decision-making process can help you improve it over time.

Conclusion

Understanding the Base Rate Fallacy is crucial for making accurate judgments and predictions. It reminds us to consider both the specific information about the case at hand and the base rate information about the overall likelihood of an event.

Avoiding the Base Rate Fallacy requires conscious effort and practice, as it often goes against our intuitive decision-making processes. By being aware of this cognitive bias and actively seeking out base rate information, we can make better, more informed decisions and judgments.

Samrat is a Delhi-based MBA from the Indian Institute of Management. He is a Strategy, AI, and Marketing Enthusiast and passionately writes about core and emerging topics in Management studies. Reach out to his LinkedIn for a discussion or follow his Quora Page