Introduction

Ambiguity Effect: Every day, we are faced with a myriad of decisions. Some are trivial, like choosing what to wear, while others are more consequential, such as deciding on a career path or making a significant investment. This is where the Ambiguity Effect, a well-documented cognitive bias, comes into play.

One of the factors that can significantly influence our decision-making process is the presence of uncertainty or ambiguity in making a decision

We have compiled a list of 125 most common Biases and Fallacies. Read Here

Defining Ambiguity Effect

The Ambiguity Effect is a cognitive bias that describes the tendency of individuals to prefer options with known probabilities of outcomes over those where the probabilities are unknown. This bias is rooted in the aversion to uncertainty and ambiguity.

In simpler terms, when faced with a decision where the outcomes are uncertain, individuals tend to favor the option where the probability of a favorable outcome is known, even if the potential rewards of the uncertain option may be higher.

Layman Example of Ambiguity Effect

In simple terms, the Ambiguity Effect is our tendency to favor known outcomes over unknown ones. Imagine you’re at a restaurant, deciding between your usual favorite dish and a new one you’ve never tried before. Despite the new dish sounding potentially delicious, you might find yourself leaning towards your usual favorite. This is because you know what to expect with your favorite dish, whereas the new dish is an unknown entity. This is a basic example of the Ambiguity Effect in action.

Academic Definitions of Ambiguity Effect

In academic terms, the Ambiguity Effect is a cognitive bias that falls under the umbrella of decision theory and behavioral economics. It refers to the tendency of individuals to prefer options with known probabilities of outcomes over those where the probabilities are unknown.

This bias is rooted in the aversion to uncertainty and ambiguity. When faced with a decision where the outcomes are uncertain, individuals tend to favor the option where the probability of a favorable outcome is known, even if the potential rewards of the uncertain option may be higher.

The Ambiguity Effect is a significant concept in understanding human decision-making processes and is often used in studies related to economics, psychology, and business. It helps explain why people often make seemingly irrational or sub-optimal decisions when faced with uncertainty.

The concept was first introduced by economist Daniel Ellsberg in 1961. He demonstrated this bias through a thought experiment, now known as the Ellsberg Paradox, which showed that people overwhelmingly preferred risks with known probabilities over those with unknown probabilities, even when the odds were the same.

We have compiled a list of 125 most common Biases and Fallacies. Read Here

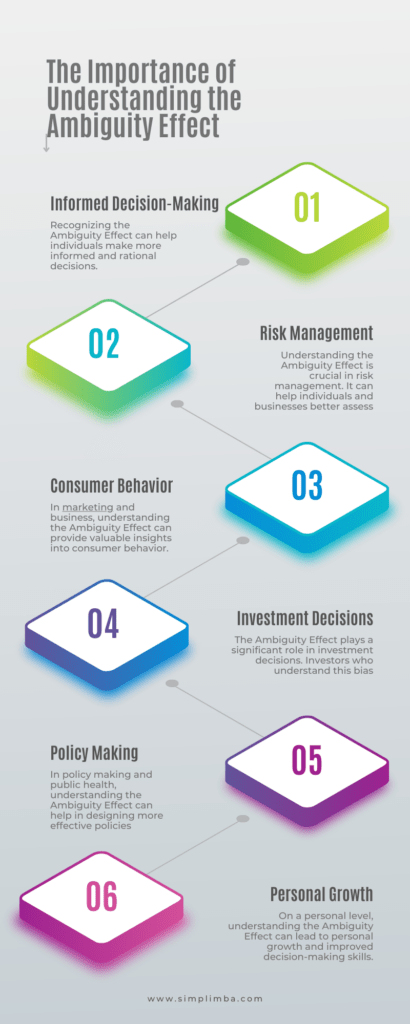

The Importance of Understanding the Ambiguity Effect

Understanding the Ambiguity Effect is crucial because it can significantly impact our choices, leading to risk aversion and potentially sub-optimal decisions. It can affect various aspects of our lives, from personal decisions like choosing a meal or a movie, to more significant decisions like investing money or making business choices.

Informed Decision-Making: Recognizing the Ambiguity Effect can help individuals make more informed and rational decisions. By understanding this bias, one can consciously choose to consider options that might otherwise be dismissed due to uncertainty.

Risk Management: Understanding the Ambiguity Effect is crucial in risk management. It can help individuals and businesses better assess the risks associated with different decisions and potentially lead to more optimal outcomes.

Consumer Behavior: In marketing and business, understanding the Ambiguity Effect can provide valuable insights into consumer behavior. This can help businesses develop strategies to influence consumer decisions and improve their products or services.

Investment Decisions: The Ambiguity Effect plays a significant role in investment decisions. Investors who understand this bias can make more informed investment choices and potentially achieve better returns.

Policy Making: In policy making and public health, understanding the Ambiguity Effect can help in designing more effective policies and interventions. By considering people’s aversion to ambiguity, policymakers can ensure that their strategies are more likely to be accepted and followed by the public.

Personal Growth: On a personal level, understanding the Ambiguity Effect can lead to personal growth and improved decision-making skills. It can help individuals navigate uncertainty and make decisions that align with their goals and values.

We have compiled a list of 125 most common Biases and Fallacies. Read Here

The Psychology involved Ambiguity Effect

The Ambiguity Effect is deeply rooted in our rational thinking process. When faced with ambiguous situations, our brain tends to take the path of least resistance, opting for options where the probability of outcome is known. This is because our brain naturally prefers certainty and predictability.

Historical Background Origin of the Ambiguity Effect Concept

The concept of the Ambiguity Effect was first described by Daniel Ellsberg in 1961. Ellsberg, an economist, and political analyst, introduced this concept through a thought experiment now known as the Ellsberg Paradox.

Ellsberg Paradox and Ambiguity Effect

The Ellsberg Paradox is a thought experiment that vividly illustrates the Ambiguity Effect. It was introduced by economist Daniel Ellsberg in 1961 and has since become a fundamental concept in decision theory and behavioral economics.

The Construct of the Ellsberg Paradox

The Ellsberg Paradox involves a simple game with two urns and colored balls. Here’s how it works:

- Urn A contains 50 red balls and 50 black balls.

- Urn B contains 100 balls in total, some of which are red and some black, but the exact distribution is unknown.

The player is asked to choose one urn and bet on the color of a ball to be drawn at random from that urn. If the ball drawn matches their bet, they win; if not, they lose.

Despite the fact that the odds of drawing a red or black ball from Urn B are also 50/50 (since there are only two possible colors and 100 balls), most people choose to bet on Urn A. This is because the probability of winning in Urn A is known (50%), while the probability of winning in Urn B is unknown.

Significance of the Ellsberg Paradox

The Ellsberg Paradox demonstrates ambiguity aversion, the preference for known risks over unknown ones. It shows that when making decisions, people tend to favor options with known probabilities over those with unknown probabilities. This is the essence of the Ambiguity Effect.

The paradox challenges the assumption of expected utility theory, a fundamental theory in economics, which assumes that people make rational decisions based on maximizing expected utility. According to this theory, people should be indifferent between choosing Urn A or Urn B since the expected outcome is the same. However, the Ellsberg Paradox shows that this is not the case, suggesting that uncertainty and ambiguity play a significant role in decision-making.

Factors Influencing Ambiguity Effect

Several factors can influence the Ambiguity Effect. These include the individual’s tolerance for risk, their level of comfort with uncertainty, and their previous experiences with similar decisions. The presence of an information deficit can also amplify the effect. For instance, if a person lacks sufficient information about the potential outcomes of a decision, they may be more likely to opt for the choice with known outcomes, even if the unknown option could potentially be more beneficial. Lets have a detailed look into some other factors

Risk Tolerance: Individuals with a higher tolerance for risk may be less influenced by the Ambiguity Effect. They might be more willing to opt for options with unknown outcomes.

Comfort with Uncertainty: People who are more comfortable with uncertainty may be less likely to exhibit the Ambiguity Effect. They might be more open to exploring unknown options.

Previous Experiences: Past experiences with similar decisions can influence the Ambiguity Effect. If a person has had positive experiences with uncertain outcomes in the past, they might be less likely to avoid such options in the future.

Information Availability: The presence or absence of information can significantly impact the Ambiguity Effect. If a person perceives that there is an information deficit about the potential outcomes of a decision, the Ambiguity Effect may be more pronounced.

Cognitive Abilities: The individual’s cognitive abilities can also influence the Ambiguity Effect. People with higher cognitive abilities might be better able to process and understand the implications of uncertainty, potentially reducing the impact of the Ambiguity Effect.

Emotional State: The individual’s emotional state at the time of decision-making can also influence the Ambiguity Effect. For instance, if a person is feeling anxious or stressed, they might be more likely to avoid uncertain options.

Social and Cultural Factors: Social and cultural factors can also play a role. For instance, in cultures where uncertainty is viewed negatively, the Ambiguity Effect might be more pronounced.

We have compiled a list of 125 most common Biases and Fallacies. Read Here

Real-World Implications of Ambiguity Effect

The Ambiguity Effect has significant real-world implications, particularly in the fields of marketing and business.

Ambiguity in Marketing

Known as ambiguity in marketing, companies often leverage this effect to influence consumer behavior. For instance, a company might highlight the certainty of their product’s benefits to make it more appealing to consumers. They might also provide detailed information about the product to reduce the perceived ambiguity and uncertainty.

Impact of Ambiguity on Consumer Behavior

The Ambiguity Effect can significantly impact consumer behavior. Consumers tend to prefer products and services with known outcomes over those with unknown outcomes. This can influence their purchasing decisions and brand preferences.

Ambiguity in Business Decisions

Similarly, the Ambiguity Effect can also influence business decisions. Businesses often prefer strategies with known outcomes over those with unknown outcomes. This can impact their strategic planning, investment decisions, and risk management practices.

Ambiguity and Investment Decisions

The Ambiguity Effect can also influence investment decisions. Investors often prefer investments with known risks over those with unknown risks, even if the potential return on the latter might be higher. This is known as ambiguity and investment decisions.

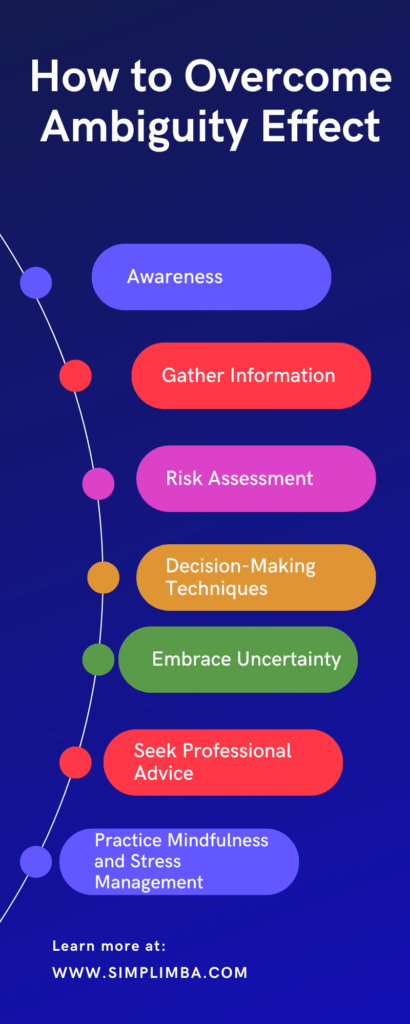

How to Overcome the Ambiguity Effect

Overcoming the Ambiguity Effect involves improving our comfort level with uncertainty and enhancing our decision-making skills.

Awareness: The first step in overcoming the Ambiguity Effect is to be aware of it. Understanding that this cognitive bias exists and how it can influence your decisions is crucial.

Gather Information: The more information you have, the less ambiguity there is. If you’re faced with a decision and you’re unsure about the outcomes, try to gather as much information as possible. This could involve doing research, asking experts, or seeking advice from others who have been in a similar situation.

Risk Assessment: Try to objectively assess the risks associated with each option. This can help you make a more informed decision and potentially mitigate the impact of the Ambiguity Effect.

Decision-Making Techniques: Use decision-making techniques that can help you deal with uncertainty. For example, you could use a decision matrix to evaluate and compare your options, or you could use scenario planning to consider different possible outcomes.

Embrace Uncertainty: Accept that uncertainty is a part of life and that it’s not always possible to know the outcome of a decision in advance. Sometimes, you might have to make a decision based on the best information you have at the time.

Seek Professional Advice: In some cases, such as financial or business decisions, it might be beneficial to seek the advice of a professional. They can provide expert insights and help you navigate the uncertainty.

Practice Mindfulness and Stress Management: High levels of stress and anxiety can exacerbate the Ambiguity Effect. Techniques such as mindfulness and stress management can help you stay calm and composed, which can in turn help you make better decisions.

Samrat is a Delhi-based MBA from the Indian Institute of Management. He is a Strategy, AI, and Marketing Enthusiast and passionately writes about core and emerging topics in Management studies. Reach out to his LinkedIn for a discussion or follow his Quora Page