Self-Attribution Bias is a cognitive bias that influences how people perceive the causes of events in their lives. This psychological phenomenon is characterized by our tendency to attribute positive outcomes to our own actions, skills, or qualities (internal factors), while blaming negative outcomes on external factors, such as luck, other people, or circumstances beyond our control. Simply speaking, Self-attribution bias is when people attribute their successes to their own abilities or efforts and blame their failures or negative outcomes on external factors beyond their control.

This bias serves a protective function by maintaining our self-esteem and positive self-image. While a certain degree of self-attribution bias may be beneficial, enabling us to take risks and maintain motivation, an overemphasis on this bias can lead to an inflated sense of self and a lack of personal accountability. This can potentially hinder personal growth and learning, as it can prevent us from acknowledging and learning from our mistakes.

Understanding self-attribution bias is crucial, as it influences our perceptions of ourselves and others, affects our decision-making processes, and impacts our interpersonal relationships. Recognizing when and how this bias operates is a critical step towards more self-awareness, balanced self-perception, and effective interpersonal communication.

We have written in detail about 125 most common biases and fallacies that impact our decision-making. Read here

Simplified definition of the self-attribution bias

Self-attribution bias is a cognitive bias where individuals tend to credit their successes to their own abilities or efforts while blaming failures on external factors beyond their control. Essentially, it’s the tendency to attribute positive outcomes to ourselves and negative outcomes to other people or circumstances.

Self Attribution Bias Examples

Workplace Scenario: Imagine a project manager who led a successful project. She attributes the project’s success entirely to her exceptional leadership skills and strategic planning. However, when a subsequent project fails, she attributes the failure to unforeseeable market conditions, an underperforming team, or inadequate resources, rather than acknowledging any mistakes or shortcomings in her leadership or planning.

Academic Scenario: A student scores well on a test and believes it’s due to his intelligence and hard work. However, when he performs poorly on another test, he blames it on the test being unfair, the teacher’s inability to explain the subject well, or distractions during his study time, rather than acknowledging that he may not have studied effectively or understood the material.

Sports Scenario: A tennis player wins a match and attributes the win to her superior skills and hard training. However, when she loses a match, she blames it on poor weather conditions, an unfair referee, or bad luck, rather than accepting that her opponent might have played better or that her performance was not up to par.

Self-attribution bias in behavioral finance

Self-attribution bias plays a significant role in behavioral finance, influencing how investors interpret and react to financial outcomes. Poor investment decisions due to self-attribution bias is very common in the field of behavioral finance

In the realm of investing and financial decision-making, self-attribution bias can lead individuals to credit their investment successes to their own skill and strategy, while blaming losses on external factors such as bad luck or unfavorable market conditions. For example, if an investor’s stock portfolio performs well, they might attribute this success to their market acumen or investment strategy. Conversely, if their portfolio performs poorly, they might blame it on an unpredictable market downturn or poor advice from others.

This bias can distort an investor’s perception of their own abilities, leading to overconfidence. Overconfident investors may take on excessive risk, believing they have more control over investment outcomes than they actually do. They might also neglect to learn from their mistakes, as they don’t fully acknowledge their role in their investment losses.

In addition, self-attribution bias can also contribute to the disposition effect, which is the tendency for investors to sell winning investments too early while holding on to losing investments for too long. This is because investors may be quicker to take credit for their gains (believing their skill led to the successful investment) and reluctant to realize their losses (as this would require admitting a mistake).

Recognizing self-attribution bias can help investors make more objective, rational decisions, potentially improving their overall investment strategy and financial outcomes.

We have written in detail about the 125 most common biases and fallacies that impact our decision-making. Read here

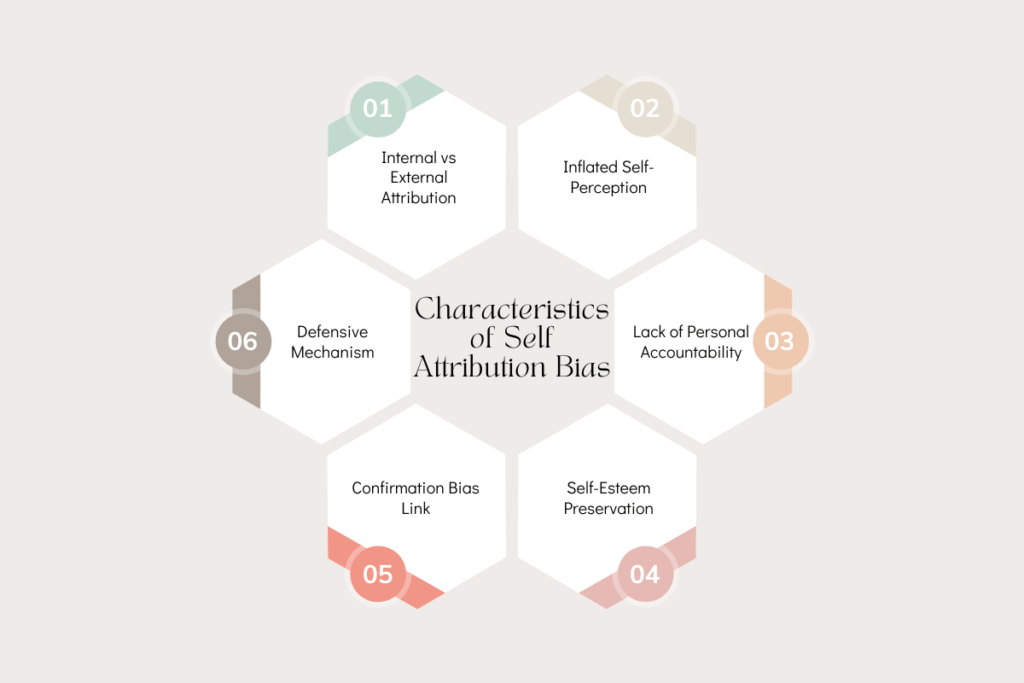

Characteristics of Self-Attribution Bias

Self-attribution bias can be characterized by the following features:

Internal vs External Attribution: One of the key characteristics of self-attribution bias is the differential attribution of outcomes. Successes are attributed to internal factors such as personal abilities, effort, or strategy (internal attribution), while failures are blamed on external circumstances beyond one’s control (external attribution).

Inflated Self-Perception: Because of the tendency to credit successes to oneself, self-attribution bias can lead to an inflated self-perception or overconfidence. Individuals might overestimate their skills, abilities, or control over outcomes, which can impact future decision-making and risk-taking behavior.

Lack of Personal Accountability: Due to attributing failures to external factors, individuals might not fully acknowledge or take responsibility for their mistakes or shortcomings. This can prevent learning and personal growth.

Self-Esteem Preservation: Self-attribution bias serves a psychological function of protecting one’s self-esteem and positive self-image. By attributing failures to external factors, individuals can maintain a more positive view of themselves.

Confirmation Bias Link: Self-attribution bias can also be linked with confirmation bias. People might selectively remember or focus on the outcomes that confirm their positive self-perception (i.e., their successes), while ignoring or downplaying outcomes that contradict this perception (i.e., their failures).

Defensive Mechanism: It can serve as a defensive mechanism to deal with failure or negative outcomes. By attributing these events to factors outside their control, individuals can avoid feelings of guilt, regret, or inadequacy.

Historical Context of Attribution Bias

Self-attribution bias, like many cognitive biases, traces its origins to the field of social psychology, particularly in the research on attribution theory in the 20th century.

Attribution theory, proposed by Fritz Heider in the 1950s, aimed to understand how individuals infer causes for their own and others’ behavior. Heider proposed that people tend to attribute their own behavior and the behavior of others to either internal dispositions (like personality) or external situations.

Building on Heider’s work, in the 1970s, Bernard Weiner and his colleagues expanded attribution theory to focus on achievement. They proposed that people attribute their successes and failures to factors that are either internal or external and either controllable or uncontrollable. This line of thinking set the stage for what would later be identified as self-attribution bias.

Later, in the 1980s, social psychologist Anthony Greenwald introduced the notion of the “totalitarian ego” to describe the subconscious biases people have that maintain their sense of self-esteem and control. This included the tendency to take credit for success while denying responsibility for failure – a direct description of self-attribution bias.

In the context of finance, the concept of self-attribution bias has been studied since at least the 1990s. Researchers started noticing that investors often credited their investment successes to their own skills and blamed their losses on bad luck or unfavorable market conditions.

We have written in detail about 125 most common biases and fallacies that impact our decision making. Read here

What is the difference between fundamental attribution error and self-serving bias?

The fundamental attribution error and the self-serving bias are two different types of cognitive biases that impact how we perceive and interpret our own behavior and the behavior of others.

Fundamental Attribution Error (FAE), also known as correspondence bias, refers to the tendency to overestimate the influence of internal or dispositional factors (like personality) and underestimate the impact of situational factors when explaining other people’s behaviors. For example, if someone sees a person behaving rudely, they might attribute this behavior to the person being innately rude, rather than considering situational factors like the person having a bad day.

On the other hand, Self-Serving Bias is a type of bias where individuals tend to attribute their successes to their own abilities or efforts (internal factors) and blame their failures on external circumstances beyond their control. This bias serves to maintain and enhance our self-esteem. For instance, if a student does well on an exam, they might attribute it to their intelligence or study efforts. If they do poorly, they might blame it on the exam being unfair or the teacher not explaining the material well.

In essence, both biases deal with attributions – how people explain the causes of behavior. However, they differ in their focus. The fundamental attribution error is more about how we interpret others’ behavior, often attributing it too heavily to their inherent traits rather than their circumstances. The self-serving bias is about how we interpret our own behavior, often in ways that protect our self-esteem.

It’s also worth noting that these biases often operate simultaneously and can interact with each other. For example, a manager might blame an employee’s poor performance (FAE – attributing the behavior to the employee’s lack of ability) while taking credit for the team’s overall success (self-serving bias – attributing positive outcomes to their own leadership skills).

Self-attribution bias vs Self-serving bias

The terms “self-attribution bias” and “self-serving bias” are often used interchangeably as they both refer to similar cognitive biases where individuals interpret events in ways that support a positive self-view. However, some subtleties distinguish the two.

Self-Serving Bias is a broader cognitive bias where people tend to take more personal responsibility for success than failure. They attribute positive events to their own character or abilities, and negative events to external factors beyond their control. This bias helps individuals maintain their self-esteem and perceive themselves in a positive light. For example, an athlete might attribute winning a game to their skills and hard work (internal factors), and losing a game to bad refereeing or poor weather conditions (external factors).

Self-Attribution Bias is considered a subtype of self-serving bias, more commonly used in financial literature, particularly in behavioral finance. This bias comes into play when investors credit their investment successes to their skills and intelligence (internal factors) but blame their losses on factors outside their control such as market volatility or bad luck (external factors).

Self Attribution Bias and Overconfidence

Self-attribution bias is the tendency for individuals to attribute successes to their own abilities or actions, while attributing failures to external circumstances. For example, a manager might attribute a successful project to their excellent leadership skills, while blaming a failed project on external factors like insufficient resources or unpredictable market changes.

Overconfidence bias, on the other hand, refers to an individual’s tendency to overestimate their abilities, knowledge, or control over situations. For instance, a person might believe they are less likely to experience negative events compared to others, or they might overestimate their ability to predict stock market movements.

These two biases often go hand in hand. For instance, if a person consistently attributes their successes to their own skills and talents (self-attribution bias), they may develop an inflated perception of their abilities or knowledge (overconfidence). Conversely, an overconfident individual may be more likely to attribute successes to themselves and failures to external circumstances, reinforcing their self-attribution bias.

We have written in detail about 125 most common biases and fallacies that impact our decision making. Read here

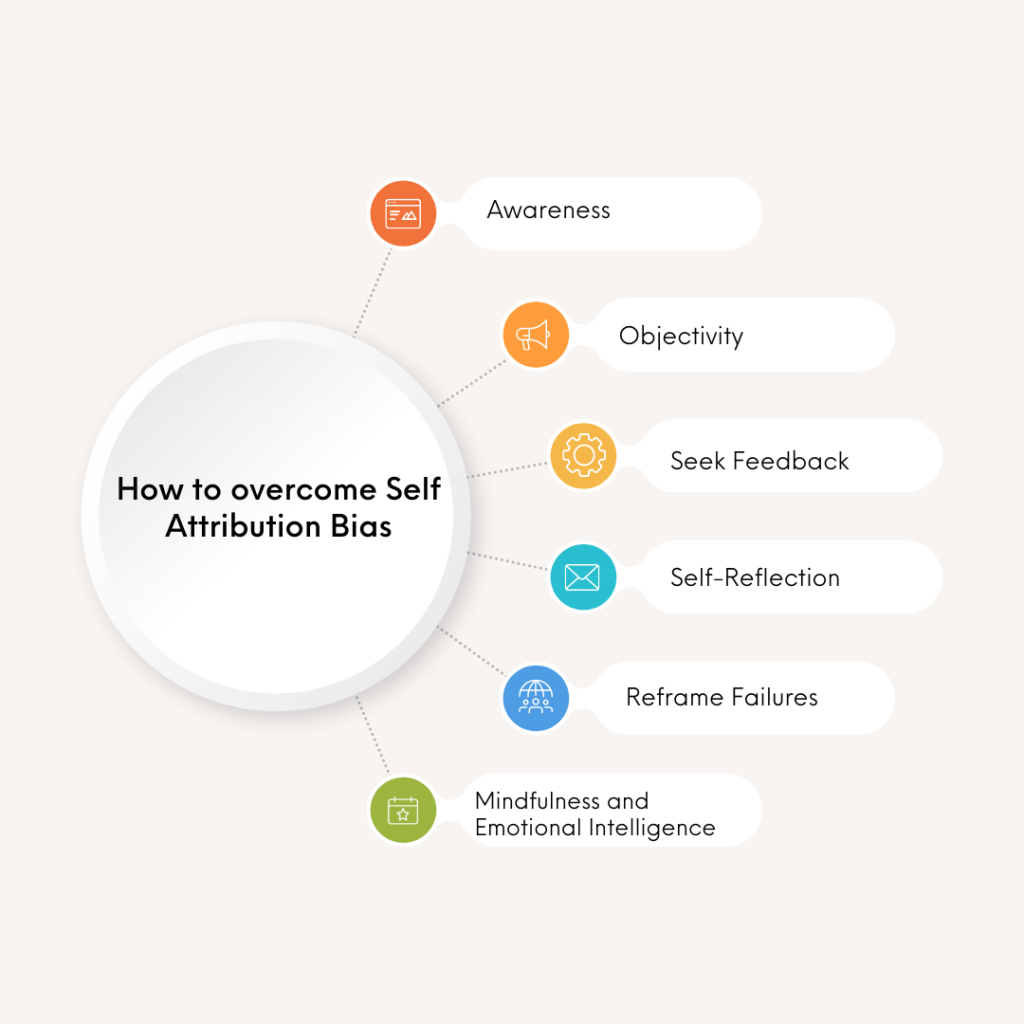

How to Overcome Self Attribution Bias

Awareness: The first step to overcoming any bias is awareness. Understand what self-attribution bias is and how it can manifest in your thoughts and actions. Recognize instances where you might be attributing successes to yourself and failures to external factors.

Objectivity: Try to adopt an objective approach when analyzing outcomes, whether they are positive or negative. This might involve seeking external perspectives or using data-driven assessments to understand the full range of factors contributing to an outcome.

Seek Feedback: Don’t shy away from feedback. Constructive criticism can provide valuable insights that can counterbalance self-attribution bias. If you’ve experienced a failure, rather than immediately attributing it to external circumstances, consider asking others for their perspective.

Self-Reflection: Regularly engage in self-reflection. Consider your successes and failures and honestly analyze what role you played in those outcomes. It can be helpful to write this down, as the act of writing can provide a more concrete, objective medium for self-reflection.

Reframe Failures: Changing the way you perceive failures can be helpful. Instead of viewing them as threats to your self-image, try to see them as opportunities for learning and growth. This can make it easier to accept personal responsibility for negative outcomes.

Mindfulness and Emotional Intelligence: Practice mindfulness and improve your emotional intelligence. Being present in the moment and understanding your emotions can help you react more rationally to success and failure.

Samrat is a Delhi-based MBA from the Indian Institute of Management. He is a Strategy, AI, and Marketing Enthusiast and passionately writes about core and emerging topics in Management studies. Reach out to his LinkedIn for a discussion or follow his Quora Page