Thinking Fast and Slow: Introduction

Welcome to the world of “Thinking Fast and Slow” by Daniel Kahneman, a captivating exploration of the two systems that shape our thinking processes. In this exceptional book, Kahneman takes us on a journey through the realms of psychology and behavioral economics, shining a light on the fascinating intricacies of human thought.

Thinking Fast and Slow Insights about the Daniel Kanheman

Daniel Kahneman, a Nobel laureate in Economics, is a pioneering psychologist and one of the most influential thinkers in the field of decision-making and judgment. With decades of research and expertise, he has revolutionized our understanding of the human mind and its inherent biases.

Kahneman’s work, often in collaboration with his colleague Amos Tversky, has challenged traditional assumptions about rationality and opened up new avenues of investigation into the complexities of human decision-making. His groundbreaking research, which earned him the Nobel Prize in 2002, has had a profound impact across various disciplines, including psychology, economics, and management.

Beyond his renowned academic achievements, Kahneman possesses a unique ability to communicate complex ideas in a clear and engaging manner. His writing style combines scientific rigor with storytelling, making his work accessible and applicable to both scholars and general readers alike.

“Thinking Fast and Slow” is the culmination of Kahneman’s years of research, distilled into a thought-provoking and enlightening exploration of how our minds work. With each chapter, he challenges our assumptions and provides us with valuable insights into the biases and fallacies that permeate our thinking.

For more book Summaries like Thinking Fast and Slow, Read here (200 Business Books Summarized)

Thinking Fast and Slow: Chapter Wise Summary

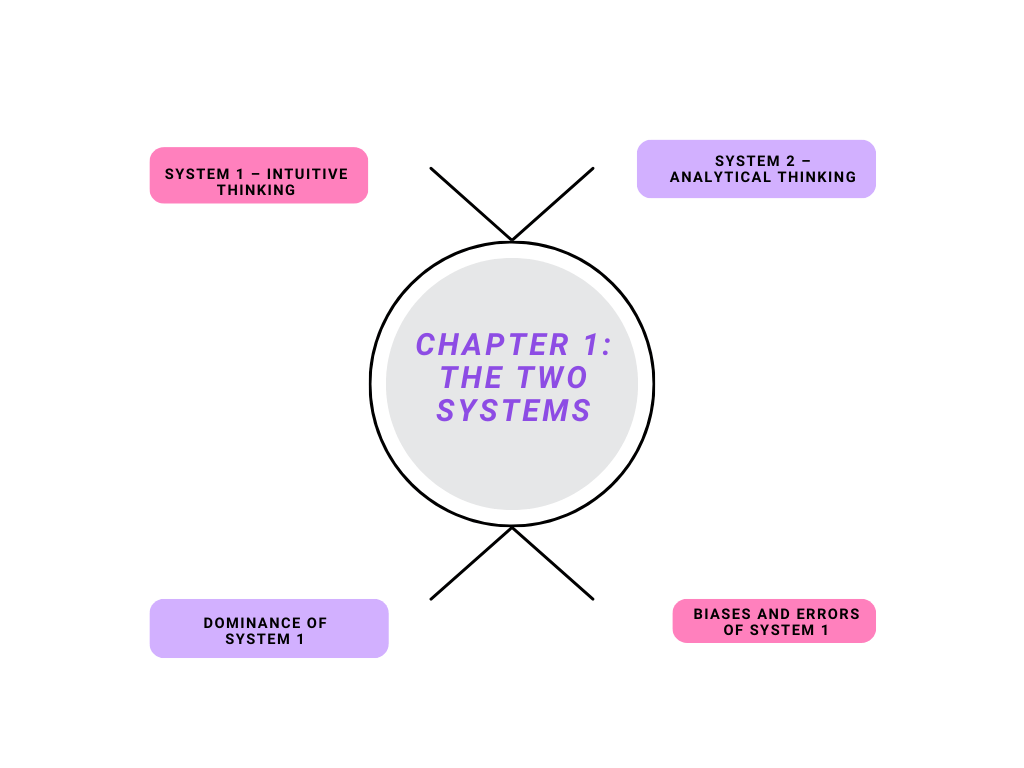

Chapter 1: The Two Systems

In this chapter, Daniel Kahneman introduces the concept of the two systems of thinking. System 1 is the fast and intuitive mode of thinking that operates automatically and effortlessly. System 2, on the other hand, is the slow and analytical mode that requires conscious effort. Kahneman explains that while System 1 is prone to biases and errors, it is the dominant system that controls our thoughts and actions.

In the opening chapter of “Thinking Fast and Slow,” Daniel Kahneman introduces the concept of two systems of thinking that govern our decision-making processes. He writes, “The mind is composed of two distinct systems: the fast system, which is the source of our intuitive and automatic thoughts, and the slow system, which requires effortful and deliberate thinking”

System 1 – Intuitive Thinking

Kahneman describes System 1 as the fast and intuitive mode of thinking that operates automatically and effortlessly. He explains, “System 1 operates automatically, quickly, and with little or no effort and no sense of voluntary control“. This system is responsible for generating instantaneous impressions, recognizing faces, and solving simple problems.

System 2 – Analytical Thinking

On the other hand, System 2 is the slow and analytical mode of thinking that requires conscious effort. Kahneman states, “System 2 allocates attention to the effortful mental activities that demand it, including complex computations“. This system is engaged when we perform calculations, make deliberate choices, and engage in logical reasoning.

Dominance of System 1

Kahneman highlights that while both systems play crucial roles in our thinking, System 1 is the dominant and influential system. He writes, “System 1 is the hero of the book… it often determines the observations and interpretations of System 2“. System 1’s intuitive judgments and impulses strongly shape our daily decisions and actions.

Biases and Errors of System 1

While System 1 operates quickly and efficiently, it is prone to biases and errors. Kahneman states, “System 1 is gullible and biased to believe, and System 2 is inattentive and sometimes lazy“. Our intuitive minds tend to rely on heuristics, or mental shortcuts, which can lead to cognitive biases and deviations from logical thinking.

For more book Summaries like Thinking Fast and Slow, Read here (200 Business Books Summarized)

Chapter 2: Heuristics and Biases

Kahneman dives deeper into the workings of System 1 and explains how it relies on heuristics, or mental shortcuts, to make judgments and decisions. However, these shortcuts often lead to biases, as they allow for errors and systematic deviations from logic. Kahneman explores several cognitive biases, such as the availability heuristic and confirmation bias, and how they impact our thinking.

In Chapter 2 of “Thinking Fast and Slow,” Kahneman delves into the heuristics, or mental shortcuts, that System 1 relies on when making judgments and decisions. These heuristics often lead to biases and errors in our thinking.

One of the biases Kahneman discusses is the availability heuristic, which is the tendency to rely on easily accessible examples or information when making judgments. He states, “When you evaluate the probability of a complex event, such as an earthquake, the ease with which you can imagine relevant instances often depends on the coherence of the story that you can construct about them” . This means that our judgments of probability are influenced by the vividness and ease with which relevant examples come to mind.

Kahneman also highlights the confirmation bias, which is the tendency to seek out information that confirms our preexisting beliefs or hypotheses. He states, “We are prone to look for and find confirmations of whatever we believe and to ignore or dismiss contradicting evidence“. This bias can lead us to discount or ignore information that challenges our beliefs, reinforcing our existing views.

Furthermore, Kahneman explores the anchoring bias, which is the tendency to rely heavily on the initial piece of information presented when making judgments or estimates. He states, “People make estimates by starting from an initial value that is adjusted to yield the final answer” . This means that the initial information, or anchor, has a significant impact on our final judgment, even if it is irrelevant or arbitrary.

Kahneman also discusses the representativeness heuristic, which is the tendency to judge the probability of an event based on how similar it is to a typical prototype or category. He explains, “The mind is designed to jump to conclusions; the jump is an inevitable consequence of the information that is stored in memory“. This heuristic leads us to overlook base rates and rely on stereotypes or prototypes, which can result in errors in judgment.

By exploring these heuristics and biases, Kahneman highlights the ways in which our System 1 thinking can lead us astray. These biases and errors in judgment can have significant implications for decision-making, as well as our perceptions of probability and risk. Understanding these heuristics and being aware of their influence can help us to make more rational and informed decisions.

For more book Summaries like Thinking Fast and Slow, Read here (200 Business Books Summarized)

Chapter 3: Overconfidence

In this chapter, Kahneman explores the concept of overconfidence and how it affects decision-making. He explains that System 1 is prone to excessive confidence, leading people to be overconfident in their abilities and judgments. Kahneman provides examples from his research, highlighting how overconfidence can lead to poor decisions and misplaced trust in one’s own intuition.

In this chapter, Kahneman explores the concept of overconfidence and how it affects decision-making. He explains that System 1 is prone to excessive confidence, leading people to be overconfident in their abilities and judgments.

One key quote from the book regarding overconfidence is:

“People who have big ego investments in their opinions (and are not inclined to change them) should be treated as holding prejudices, not opinions.”

Kahneman highlights that when individuals become overconfident in their opinions, they tend to hold on to them stubbornly, even when faced with contradictory evidence. This highlights the importance of recognizing overconfidence as a potential bias in decision-making.

Another quote that underscores the impact of overconfidence is:

“Because overconfidence is associated with charisma, skill, and accomplishment, people who show confidence are often rewarded for it, regardless of their actual abilities.“

Kahneman explains that overconfidence is often mistaken for competence, leading to individuals being rewarded and given leadership roles based on their perceived confidence, rather than their actual abilities. This can have significant consequences in various domains, including business and politics.

Additionally, Kahneman discusses the illusion of skill as a result of overconfidence

“An unbiased appreciation of uncertainty is a cornerstone of rationality—but it is not what people and organizations want.”

Here, he highlights the aversion people have towards uncertainty and their tendency to favor confident individuals who project a sense of certainty. However, this can lead to an underestimation of risks and an overemphasis on overconfident individuals, ultimately impacting the quality of decision-making.

Overall, in this chapter, Kahneman emphasizes the dangers of overconfidence and how it can distort our judgments and decision-making processes. Being aware of this bias and actively questioning our own level of confidence can help mitigate the negative effects of overconfidence and improve decision outcomes.

For more book Summaries like Thinking Fast and Slow, Read here (200 Business Books Summarized)

Chapter 4: Choices

The focus of this chapter is on decision-making and the factors that influence our choices. Kahneman introduces the concept of prospect theory, which explains how people evaluate and weigh potential gains and losses. He discusses the distinction between the experiencing self and the remembering self, and how these different perspectives can lead to conflicting preferences and choices.

In Chapter 4 of “Thinking Fast and Slow,” Daniel Kahneman delves into the concept of choices and the factors that influence our decision-making.

Kahneman introduces the concept of prospect theory, which explains how people evaluate and weigh potential gains and losses. He discusses how our decision-making is influenced by the reference point, or the starting point from which we evaluate outcomes. Kahneman writes, “Research has shown that as a species, humans are more motivated to avoid losses than to pursue gains” . This insight highlights our tendency to be risk-averse when faced with potential losses, often leading us to make conservative choices.

The author also explores the distinction between the experiencing self and the remembering self. He observes, “Happiness is not experienced in the moment but is a judgment about the past that includes both experienced and remembered events“. Kahneman explains that our memory of an event often shapes our overall evaluation of it, even if our actual experience during the event was different. This distinction between the two selves can lead to conflicting preferences and choices, as our remembered self heavily influences our decision-making.

Kahneman further emphasizes the role of the remembering self, stating, “When we choose between experiences, we mostly consider the memory of the experiences, not the actual experience in the moment“. This idea highlights the significant influence of memory and the lasting impact it has on our choices. Our decisions are often based on perceived satisfaction and the creation of positive memories rather than the actual experience itself.

To support his arguments, Kahneman provides various examples and experiments throughout the chapter. One such experiment involves participants undergoing two painful experiences. Afterward, they were asked to rate the overall level of pain they had experienced. Interestingly, the participants’ memory of the pain was not based on the sum of the pain during both instances, but rather the peak pain level and the pain intensity at the end. This phenomenon, referred to as the “peak-end rule,” illustrates how our remembering self focuses on particular moments and neglects the duration of an event.

In conclusion, Chapter 4 of “Thinking Fast and Slow” delves into the intricacies of choices and decision-making. Kahneman highlights the role of prospect theory, the distinction between the experiencing self and the remembering self, and the impact of memory on our evaluations. This chapter sheds light on the complexities behind our choices and helps readers understand the underlying biases that influence our decision-making processes.

For more book Summaries like Thinking Fast and Slow, Read here (200 Business Books Summarized)

Chapter 5: Two Selves

Building upon the previous chapter, Kahneman delves deeper into the concept of the experiencing self and the remembering self. He explains that our memory of an event often shapes our overall evaluation of it, even if our actual experience during the event was different. Kahneman explores the implications of this insight on decision-making and happiness.

In this chapter, Daniel Kahneman explores the concept of the experiencing self and the remembering self, and how they shape our perceptions and choices.

Kahneman writes, “The division of attention between the objective and subjective selves, the experiencing self and the remembering self, is never equal: the voice of the present, informed by the noble passion for justice, always takes precedence over the voice of the past. Consequently, the largest component of the self that endures from any experience is the remembering self“.

He introduces the idea that our memories of an event often shape our overall evaluation of it, even if our actual experience during the event was different. Kahneman states, “How you think of your life at any given time has a profound effect on how you feel and live“.

Furthermore, Kahneman highlights the discrepancies between the experiencing self and the remembering self, stating, “A life that goes well for the experiencing self is one that is cheerful, fulfilling, and meaningful. A life that goes well for the remembering self is one that is filled with enjoyable moments and memorable experiences“.

He also discusses the concept of the “peak-end rule,” which suggests that when evaluating past experiences, people tend to primarily remember the peak moments of pleasure or pain, as well as the final moments. Kahneman writes, “An experience that is short in duration but does not have the pitfall of having a painful ending has a good chance of being judged more favorably” .

Kahneman underscores the implications of these insights on decision-making and happiness, stating, “Understanding this distinction between the experiencing self and the remembering self…can make a significant difference to individuals“. He emphasizes that our memories play a crucial role in guiding our choices and influencing our overall well-being.

For more book Summaries like Thinking Fast and Slow, Read here (200 Business Books Summarized)

Chapter 6: The Law of Small Numbers

Here, Kahneman examines our tendency to rely on small samples and draw broad conclusions from them. He explains that our minds often overlook statistical principles, leading us to make faulty judgments based on limited data. Kahneman further explores how this bias can impact our thinking, particularly in the realms of risk assessment and the interpretation of random events.

In this chapter, Kahneman explores our tendency to rely on small samples and draw broad conclusions from them. He delves into the concept that our minds often overlook statistical principles, leading us to make faulty judgments based on limited data.

Kahneman explains, “Our minds are designed to believe and create coherent stories, even when confronted with limited information. We tend to overlook the true nature of small samples and draw far-reaching conclusions from them“.

He presents the concept of the law of small numbers, stating, “We often assume that small samples are representative of the larger population, when in fact, they can be highly unrepresentative due to natural randomness“.

Kahneman illustrates the dangers of relying on small samples with an example: “Imagine a coin has been flipped four times, resulting in four consecutive heads. Our intuition may tell us that the next toss is more likely to be tails, as the streak of heads seems unlikely to persist. However, this is an illusion. Each coin toss is independent, and the previous outcomes have no bearing on future outcomes. The law of small numbers can deceive us into making incorrect predictions.

He discusses the implications of this bias in various domains, including the stock market. Kahneman states, “Investors often make decisions based on short-term patterns they observe in the market, assuming they are indicative of future trends. However, such patterns are frequently a result of luck and do not represent the true nature of the market. Relying on small samples can lead to poor investment choices“.

Kahneman concludes the chapter by emphasizing the importance of recognizing the limitations of small samples. He advises, “We must be cautious when drawing conclusions from limited information. Understanding the law of small numbers can help us avoid falling into the trap of overgeneralization and make more informed judgments“

For more book Summaries like Thinking Fast and Slow, Read here (200 Business Books Summarized)

Chapter 7: Anchors

Anchoring refers to the tendency to rely heavily on the initial piece of information presented when making judgments or estimates. Kahneman explains how anchoring affects our decision-making, often leading to insufficient adjustment from the anchor. He provides examples and insights into how this bias plays out in various real-life scenarios and its impact on negotiations and pricing.

In Chapter 7 of “Thinking Fast and Slow,” Daniel Kahneman explores the impact of anchors on decision-making and judgment. An anchor is the initial piece of information presented to an individual, which influences subsequent judgments and estimates. Kahneman explains how anchors can bias our thinking and lead to insufficient adjustment from the initial reference point.

One notable quote from this chapter is:

“People who are asked to guess the percentage of African countries in the United Nations that are members of the African Union come up with a much higher estimate than those who are asked to guess the percentage of African countries in the United Nations.”

This quote highlights how the initial anchor, the reference to the African Union, can heavily influence judgments. Even though the anchor carries no real informational value, participants tend to adjust their estimates based on it.

Kahneman also presents an example related to negotiation, stating:

“The outcome of a negotiation can be easily influenced by the opening position. The first offer made in a price negotiation has an anchoring effect that is disproportionate to its informative value.”

This quote emphasizes how the initial offer in a negotiation can significantly shape subsequent offers and counteroffers, as the anchor creates a cognitive reference point for both parties involved.

Kahneman further discusses the power of anchors and the challenges they present, stating:

“The main psychological handicap of anchoring is that anchoring effects are not self-limiting. Because people come to insufficiently adjust from the anchor, their answers remain too close to the questions.”

This quote highlights how individuals tend to stay too close to the initial anchor and fail to make the appropriate adjustments, leading to biased judgments

. Anchors can strongly influence our thinking, and it requires conscious effort to overcome their impact.

Another important quote from this chapter is:

“Once we have an anchor, we will adjust from it, but there is a limit to how far we will move.”

This quote emphasizes the limited adjustment individuals make from an anchor. While we do adjust our judgments, we tend to anchor too much and therefore fail to arrive at a truly rational assessment.

For more book Summaries like Thinking Fast and Slow, Read here (200 Business Books Summarized)

Chapter 8: Availability

In this chapter, Kahneman investigates the availability heuristic, which is the tendency to rely on easily retrievable information when making judgments or decisions. He explains that what comes to mind easily often influences our perceptions of likelihood and frequency, even if it may not accurately represent reality. Kahneman presents evidence and examples to illustrate the power of this bias.

In this chapter, Kahneman explores the availability heuristic, which is the tendency to rely on easily retrievable information when making judgments or decisions. He explains that what comes to mind easily often influences our perceptions of likelihood and frequency, even if it may not accurately represent reality.

Kahneman presents the following quote to illustrate the power of the availability heuristic:

“A remarkable aspect of your mental life is that you are rarely stumped. Your System 1 is highly skilled at constructing a story that sounds plausible. But unless you start searching systematically for alternative interpretations and actively look for disconfirming evidence, the default option is to maintain the status quo.”

This quote emphasizes how our minds quickly construct stories that make sense to us, based on the readily available information. However, Kahneman warns that this can lead to biased thinking if we fail to consider other interpretations or actively seek evidence that challenges our initial assumptions.

Kahneman further explains the phenomenon with another quote:

“Indeed, there is evidence that the sense that one is familiar with specific details of an event that actually did not happen is driven by the experience of imagining it. Events that are easy to imagine or are plausible in a given context are easier to retrieve from memory than events that are harder to imagine or are inconsistent with the context.”

This quote highlights how our ability to imagine events and construct mental scenarios influences our perception of their likelihood. Our minds tend to rely on what is easy to imagine or what seems plausible, making it more readily available in our memory. This availability bias can lead us to overestimate the likelihood of such events, even if they are highly unlikely in reality.

Kahneman concludes the chapter with the following quote:

“[The availability heuristic] is not caused by heuristic error; it proves to be correct often enough to contribute to the incorrectness of our sense of understanding the world.”

This quote emphasizes that the availability heuristic is not always erroneous. In fact, it is often correct and contributes to our sense of understanding the world. However, Kahneman highlights that when it does lead to errors, it can have significant impacts on our judgments and decisions.

For more book Summaries like Thinking Fast and Slow, Read here (200 Business Books Summarized)

Chapter 9: The Illusion of Understanding

Kahneman explores the tendency to overestimate our own understanding of complex phenomena. He explains that this illusion of understanding arises from the coherence we create in our minds, based on limited and simplified information. Kahneman warns against the dangers of this illusion and emphasizes the importance of humility and critical thinking.

In this chapter, Kahneman explores the tendency to overestimate our own understanding of complex phenomena. He examines the illusion of understanding that arises from the coherence we create in our minds based on limited and simplified information.

Kahneman cautions against the dangers of this illusion, stating, “We don’t like to experience doubt and find comfort in the feeling of coherence. We must resist the temptation to believe that we understand the past, because we are not really learning from experience. We are really only learning from the confidence we have in our understanding, and this confidence is not justified“.

He explains that the illusion of understanding stems from our innate desire to create a coherent narrative and to impose causality on events. Kahneman writes, “Narrative fallacies arise inevitably from our continuous attempt to make sense of the world. We want to tell stories that make sense, but we’re easily seduced by our instincts to provide causal explanations for events, even when no causal relationship exists“.

Moreover, Kahneman discusses the impact of the illusion of understanding on decision-making, stating, “The better we understand the causes of an event, the more likely we are to accept it as inevitable…The sense-making machinery of System 1 cannot be turned off, and any effort to prevent it from operating creates the experience of confusion and dissatisfaction“.

Kahneman highlights the importance of humility and critical thinking in overcoming the illusion of understanding, noting, “Vigilance and self-control are required to avoid a highly aversive mental state. Every aspect of our minds that works well will sometimes fool us by creating a powerful sense of understanding that is not justified. Humility is a virtue when it comes to forecasting and decision-making“.

Chapter 10: The Illusion of Validity

The illusion of validity refers to our tendency to believe that our judgments and predictions are accurate, even when evidence suggests otherwise. Kahneman discusses the factors that contribute to this illusion, such as the availability of relevant information and the coherence of the story we construct. He highlights the challenges of accurate forecasting and the pitfalls of relying solely on intuition.

In this chapter, Kahneman delves into the illusion of validity, which refers to our tendency to believe in the accuracy and reliability of our judgments and predictions, even in the face of contradictory evidence. He explores the factors that contribute to this illusion and highlights the challenges of accurate forecasting.

Kahneman states, “The confidence we experience as we make a judgment is not a reasoned evaluation of the probability that it is right. Confidence is a feeling, one determined mostly by the coherence of the story and by the ease with which it comes to mind, even when the evidence for the story is sparse and unreliable“. This quote underscores the idea that our confidence in our judgments is often influenced by the narrative we construct in our minds, rather than by the actual evidence supporting it.

Moreover, he states, “The evidence supports Herbert Simon’s generalization that in chess, as in other fields as well, ‘Real-world ill-defined domains differ from those of chess in that there are no limitore free ride to the sporting point”’. Here, Kahneman highlights the limits of expertise and the challenges of making accurate predictions in real-world situations compared to the game of chess, where well-defined rules and consistent patterns exist.

Kahneman also discusses the role of contestability in assessing the accuracy of predictions. He says, “The ultimate obstacle to the use of scoring rules and to the measurement of forecasting skill is lack of contestability. Unless there is a cost attached to forecasters’ errors, they have no incentive to improve their scores“. This quote emphasizes the importance of having consequences or accountability for inaccurate predictions in order to incentivize forecasters to improve their skills.

Furthermore, Kahneman explains, “Most experts are trained in one model of analysis – their field’s standard approach – and have adopted it as their own. They are often unaware of alternative models and tend to stick to their own regardless of its actual predictive superiority“. Here, he highlights the limitations of expert intuition and the tendency for experts to rely solely on the knowledge and tools within their own domain, overlooking potentially superior approaches.

For more book Summaries like Thinking Fast and Slow, Read here (200 Business Books Summarized)

Chapter 11: Intuitions vs. Formulas

In this chapter, Kahneman explores the conflict between expert intuition and statistical formulas. He presents evidence that suggests statistical models often outperform expert judgment, especially in complex and uncertain domains. Kahneman discusses the limitations of intuition and advocates for the use of algorithms and systematic decision-making processes.

In this chapter, Kahneman delves into the debate between relying on expert intuition and using statistical formulas. He presents evidence and arguments to suggest that statistical models often outperform human judgment, particularly in complex and uncertain situations.

Kahneman writes, “The idea that experts are particularly prone to failures of intuition seems paradoxical, but it is true“. He explains that expert intuition can be influenced by biases and heuristics, leading to errors in judgment. When faced with complex problems, relying solely on expert intuition can lead to suboptimal decisions.

To support his claims, Kahneman references a study conducted by Robyn Dawes, a psychologist, who compared the predictive accuracy of clinical psychologists to simple algorithms. He states, “The overall result of the study was alarming: the simple algorithm predicted better than the experts“.

In another study mentioned by Kahneman, researchers compared human judges to a statistical model in predicting the future success of junior army officers. The statistical model outperformed the human judges, leading Kahneman to state, “It is quite sobering that [the judges’] errors were larger, more extreme, and more statistically significant than those of the formula“.

Furthermore, Kahneman argues that even experts themselves should be wary of their intuitions. He states, “When experts try to make predictions in a situation of genuine uncertainty, they end up thinking like algorithms” . He suggests that experts should rely on statistical models and systematic decision-making processes rather than solely relying on their gut instincts.

For more book Summaries like Thinking Fast and Slow, Read here (200 Business Books Summarized)

Chapter 12: Conclusion

Kahneman concludes the book by summarizing the key insights and implications of his research. He emphasizes the importance of understanding the limitations of human thinking and decision-making, and how we can improve our judgments by being aware of biases and employing systematic approaches. Kahneman encourages readers to be critical thinkers and seek ways to overcome the limitations of our intuitive minds

Samrat is a Delhi-based MBA from the Indian Institute of Management. He is a Strategy, AI, and Marketing Enthusiast and passionately writes about core and emerging topics in Management studies. Reach out to his LinkedIn for a discussion or follow his Quora Page