Introduction

Brief explanation of the term ‘Arm’s Length Price’

At its most basic, the Arm’s Length Price refers to the price at which two unrelated and independent parties would agree to transact under normal market conditions. It’s the price you would expect to see if the two parties were dealing with each other purely on commercial terms, without any other relationships or factors influencing the transaction.

Explanation of why understanding Arm’s Length Price is important

Understanding the Arm’s Length Price is incredibly important, especially for businesses that have international operations or for those involved in cross-border transactions. This is because the Arm’s Length Price is used as a standard to ensure that multinational companies are correctly pricing their goods, services, or intangible properties in their intercompany transactions to prevent profit shifting and tax avoidance.

An overview of what the blog post will cover

In this blog post, we will delve into the concept of the Arm’s Length Price, exploring its significance, methods of determining it, and its role in transfer pricing. We will also examine the challenges associated with it, the recent developments, and the future trends in the application of this principle. Through real-world case studies, we’ll bring these concepts to life, providing a better understanding of the practical implications of the Arm’s Length Price.

Join us on this journey as we navigate the complex world of Arm’s Length Price and its pivotal role in shaping international business transactions. Whether you’re a business owner, a tax professional, or just someone interested in international economics, this comprehensive guide is sure to shed light on a topic that governs so much of the global business landscape.

What is Arm’s Length Price?

To dive deeper into the Arm’s Length Price, it’s necessary to understand its roots in economic theory and law. The Arm’s Length Price is a theoretical price point at which two independent, unrelated parties would agree to a transaction. Both parties in this transaction should be acting independently, have equal bargaining power, and be motivated solely by their self-interest.

More in-depth definition of Arm’s Length Price

From a mathematical perspective, consider two entities, Entity A and Entity B. If Entity A sells goods to Entity B at a price P, the price P is considered to be at arm’s length if it is the same price that Entity A would charge an independent, unrelated party in the open market under the same or similar circumstances.

To put it formally, if:

P_AB = price charged by A to B in the transaction, and

P_AM = price charged by A to an unrelated entity M in the market,

The transaction between A and B is considered at arm’s length if P_AB = P_AM.

In the context of international tax law, the arm’s length principle is the condition that transactions between related entities should be priced as if the entities were unrelated, thereby reflecting the true economic value of the transaction. The Organisation for Economic Co-operation and Development (OECD) provides guidelines for applying this principle, which have been widely adopted globally. This principle is used to prevent multinational corporations from manipulating their internal transactions to shift profits to low-tax jurisdictions, thereby avoiding tax in high-tax jurisdictions.

Explanation of the arm’s length principle in international tax law

In international tax law, the arm’s length principle serves as a standard for ensuring that cross-border transactions between related entities (also known as intercompany transactions or transfer pricing) are priced fairly. This principle is endorsed by the Organisation for Economic Co-operation and Development (OECD) and is widely incorporated in bilateral tax treaties around the world.

The arm’s length principle stipulates that the amount charged in a transaction between two related entities should be the same as if the transaction had occurred between two unrelated entities under similar conditions. This principle is used to ensure that multinational corporations cannot artificially inflate or deflate prices in intercompany transactions to shift profits to low-tax jurisdictions and avoid taxes in high-tax jurisdictions.

To put it simply, the arm’s length principle is intended to prevent base erosion and profit shifting (BEPS), a tax avoidance strategy used by multinational companies. Under BEPS, companies shift their profits from high-tax jurisdictions to low-tax jurisdictions, thereby eroding the tax base of the high-tax jurisdictions.

Implementing the arm’s length principle can be challenging, due to the complexity of accurately determining what the terms of a transaction would have been between unrelated parties under similar circumstances. There are several methods approved by the OECD to establish arm’s length pricing, which include the Comparable Uncontrolled Price (CUP) method, Resale Price Method (RPM), Cost Plus Method (CPM), Transactional Net Margin Method (TNMM), and Profit Split Method (PSM). These methods will be discussed in detail in the next section.

Examples of Arm’s Length Price in real-world business transactions

Let’s consider a real-world example for better clarity. Suppose a US-based company, XYZ Corp, sells software to a subsidiary in Germany. If unrelated software companies are selling similar software for €1000 per license in the German market, then to meet the arm’s length standard, XYZ Corp should also charge its German subsidiary around €1000 per license. If XYZ Corp charges significantly less or more, it could attract the attention of tax authorities who may suspect the company of price manipulation for tax purposes.

Why is Arm’s Length Price Important?

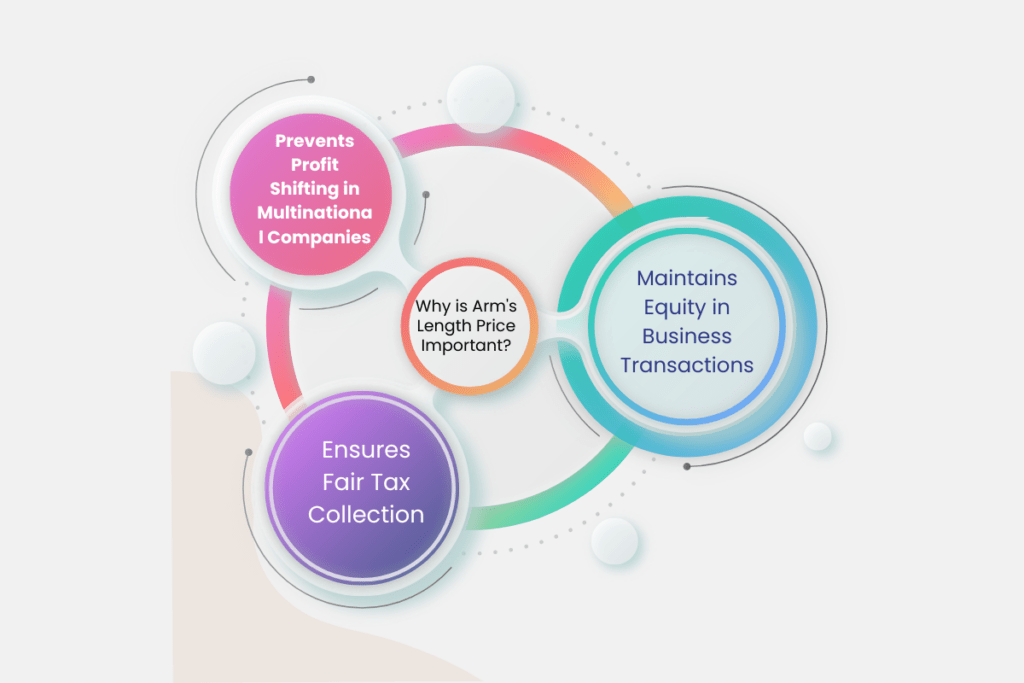

Discussion on how Arm’s Length Price prevents profit shifting in multinational companies

The Arm’s Length Price plays a pivotal role in international trade and taxation. Its significance is multifaceted and can be highlighted as follows:

Prevents Profit Shifting in Multinational Companies: The Arm’s Length Price is a crucial tool in preventing Base Erosion and Profit Shifting (BEPS), a strategy employed by multinational companies to shift profits from high-tax jurisdictions to low-tax jurisdictions. By requiring intercompany transactions to be priced as if they were between unrelated parties, the Arm’s Length Price eliminates the opportunity for multinational corporations to manipulate pricing for tax advantages.

Ensures Fair Tax Collection: The use of Arm’s Length Price in transfer pricing ensures that taxable profits are allocated appropriately among different countries where a multinational company operates. This prevents the erosion of a country’s tax base and ensures that each jurisdiction gets its fair share of tax revenue. It’s an essential mechanism for governments to protect their tax revenues.

Maintains Equity in Business Transactions: By ensuring that intercompany transactions are priced at market rates, the Arm’s Length Price maintains fairness and equity in business transactions. This promotes a level playing field in the global market and prevents multinational companies from gaining an unfair advantage through internal pricing mechanisms.

Methods for Determining Arm’s Length Price

Overview of the five methods under OECD guidelines

The OECD guidelines provide five different methods for determining the Arm’s Length Price. Here’s an overview and explanation of each one:

Comparable Uncontrolled Price (CUP) Method

This method involves comparing the price charged in a controlled transaction (i.e., a transaction between related entities) to the price charged in a comparable uncontrolled transaction (i.e., a transaction between unrelated entities). If the circumstances and terms of the transactions are similar enough, the price of the uncontrolled transaction can be considered as the Arm’s Length Price.

Mathematically, if P_C is the price of a controlled transaction and P_U is the price of a comparable uncontrolled transaction, under the CUP method, P_C should equal P_U for the transaction to be considered at arm’s length.

For example, if a company sells a product to its related party for $50 per unit but sells the same product to an unrelated party under similar conditions for $60, the Arm’s Length Price should be $60 per unit according to the CUP method.

Resale Price Method (RPM)

The RPM is used when a product is purchased from a related party and then resold to an independent entity. The Arm’s Length Price is computed by subtracting the gross margin that an entity would earn on a comparable transaction with an independent entity from the resale price to the independent entity.

Mathematically, if P_R is the resale price to an independent entity and GM is the gross margin of a comparable transaction, the Arm’s Length Price (P_ALP) is given by

P_ALP = P_R – GM.

For instance, if a reseller buys a product for $70 from a related party and sells it to an independent customer for $100, and the gross margin on a comparable transaction is 20%, the Arm’s Length Price would be $100 – 20%*$100 = $80.

Cost Plus Method (CPM)

This method is used when a product is sold to a related entity, which then adds its own markup before selling the product to an independent customer. The Arm’s Length Price is determined by adding a markup to the costs incurred by the supplier, where the markup is what would be charged in a comparable transaction with an independent entity.

Mathematically, if C is the cost of production and M is the markup percentage in a comparable transaction, the Arm’s Length Price (P_ALP) is given by

P_ALP = C + M*C.

For example, if the production cost of a product is $40 and the markup in a comparable transaction is 25%, the Arm’s Length Price would be $40 + 25%*$40 = $50.

Transactional Net Margin Method (TNMM)

The TNMM compares the net profit margin of the controlled transaction with the net profit margin of a comparable uncontrolled transaction. The Arm’s Length Price is then adjusted to achieve the same net profit margin.

The net profit margin can be calculated as the ratio of net profits to an appropriate base (such as costs, sales, or assets). If NP_C/S_C is the net profit margin of the controlled transaction and NP_U/S_U is that of a comparable uncontrolled transaction, then the Arm’s Length Price can be determined by adjusting the controlled transaction so that NP_C/S_C = NP_U/S_U.

Profit Split Method (PSM)

This method is often used when transactions are highly interrelated and cannot be evaluated separately. It involves determining the combined net profit of the related entities from the controlled transactions, and then splitting this combined profit between the entities based on an economically valid basis that approximates the division of profits that would have been anticipated in an agreement made at arm’s length.

The basis for splitting the profit could be the relative value of the functions performed by each of the related entities. If the combined profit is CP and F_A and F_B are the relative contributions of Entity A and Entity B, then the profits could be split such that

Profit_A = F_A / (F_A + F_B) * CP and Profit_B = F_B / (F_A + F_B) * CP.

Role of Transfer Pricing in Arm’s Length Price

Explanation of the term ‘transfer pricing’

gible property, or services to associated enterprises. In simple terms, it is the price at which divisions of a company transact with each other, such as during the trade of supplies or labor between departments. Transfer prices are used when individual entities of a larger multi-entity firm are treated and measured as separately run entities.

The concept of Arm’s Length Price is deeply intertwined with transfer pricing. Since transfer pricing involves transactions between related entities, it is essential to ensure these transactions are priced fairly. This is where the Arm’s Length Price comes in – it provides a standard for pricing intercompany transactions as if they were between unrelated parties, thereby ensuring fairness and preventing tax avoidance.

Examples of how transfer pricing adjustments can affect Arm’s Length Price

Let’s consider a multinational company with a subsidiary in a country with a higher tax rate. The parent company sells goods to the subsidiary at an inflated price, resulting in lower profits (and therefore lower taxes) for the subsidiary in the high-tax country. The parent company, on the other hand, records higher profits in its home country, where the tax rate is lower.

This strategy, while advantageous for the company, erodes the tax base in the high-tax country. To combat this, tax authorities in the high-tax country could make a transfer pricing adjustment. They would determine an Arm’s Length Price for the goods and adjust the subsidiary’s taxable income accordingly. If the Arm’s Length Price of the goods is lower than the price the subsidiary paid, the subsidiary’s taxable income would be increased by the difference, resulting in higher taxes in the high-tax country.

Challenges and Criticisms of Arm’s Length Price

Explanation of the difficulties in accurately determining Arm’s Length Price

Determining an Arm’s Length Price can be complex due to several reasons. First, finding comparable transactions between unrelated parties can be difficult, especially for unique or highly specialized goods or services. Second, it requires a significant amount of data and information, which may not always be available or may be expensive to obtain. Third, even if comparable transactions can be found, adjusting for differences in conditions or terms can be challenging and somewhat subjective.

Discussion on criticism and controversy surrounding Arm’s Length Price

Some critics argue that the Arm’s Length Principle, while theoretically sound, is difficult to apply in practice and can lead to unpredictable results. There is also criticism that it is not effective at preventing tax avoidance by multinational corporations, as these companies can still manipulate prices within the arm’s length range or use other strategies to shift profits to low-tax jurisdictions. Additionally, the complexity and subjectivity of determining Arm’s Length Prices can lead to disputes between tax authorities and multinational companies, resulting in uncertainty and potential double taxation.

Overview of potential alternatives to the Arm’s Length Price approach

- Given these challenges and criticisms, some have proposed alternative approaches to international taxation. One of these is formulary apportionment, where a multinational company’s global profit is allocated to different countries based on a formula, typically considering factors like sales, assets, and employment in each country. This approach is used for state-level corporate taxation in the United States and for certain types of companies within the European Union.

Another approach is the concept of unitary taxation, where the multinational enterprise is considered as a single unified business rather than a collection of separate entities. The firm’s global profits are then apportioned to each country where it does business, based on a formula accounting for tangible factors such as the proportion of sales, assets, and employees in that country.

The OECD has also been exploring modifications to the arm’s length principle under its Base Erosion and Profit Shifting (BEPS) project, including measures to address challenges posed by the digital economy. These alternatives, however, have their own complexities and issues and are subject to ongoing debate and discussion.

Recent Developments and Future Trends in Arm’s Length Pricing

Discussion on how digital economies are impacting Arm’s Length Price and transfer pricing

The rise of digital economies has brought new challenges for Arm’s Length Pricing and transfer pricing. Digital businesses often have a significant economic presence in a country without having a physical presence, which traditional transfer pricing rules are not well-equipped to handle. Also, digital businesses often rely heavily on unique intangibles, making it difficult to find comparable transactions to determine an Arm’s Length Price. The OECD’s Base Erosion and Profit Shifting (BEPS) project has been working on these issues, leading to the development of new approaches such as the “significant economic presence” concept and new methods for valuing intangibles.

The OECD’s BEPS project has led to several updates to the guidelines for Arm’s Length Pricing. These include new guidelines for valuing intangibles, assessing the level of risk assumed by different entities in a multinational group, and determining when a country has the right to tax a multinational enterprise. In 2020, the OECD also launched a new initiative to achieve a consensus-based solution on taxing the digital economy, which may result in further changes to Arm’s Length Pricing and transfer pricing rules.

Predictions for the future of Arm’s Length Price

The future of Arm’s Length Pricing will likely continue to be influenced by the ongoing digitalization of the economy. New technologies such as blockchain and artificial intelligence may also impact transfer pricing by improving data analysis and comparability assessments. There is also likely to be continued debate over the appropriate balance between the arm’s length principle and other approaches to international taxation. Whatever the future holds, it is clear that Arm’s Length Pricing will continue to be a critical concept in international tax law, evolving in response to changes in the global business environment.

Samrat is a Delhi-based MBA from the Indian Institute of Management. He is a Strategy, AI, and Marketing Enthusiast and passionately writes about core and emerging topics in Management studies. Reach out to his LinkedIn for a discussion or follow his Quora Page