Definition and Introduction

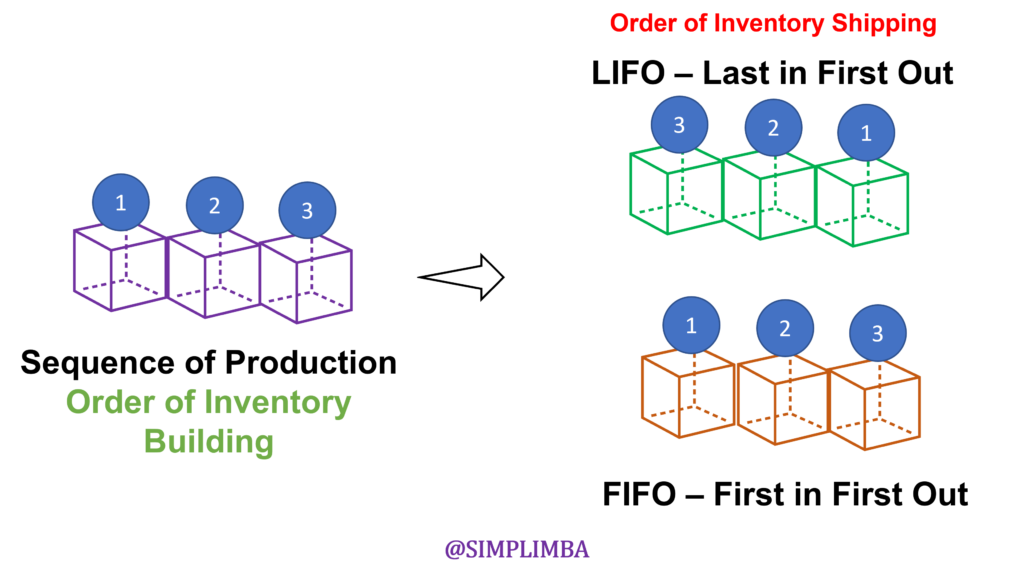

Lifo Stands for last in first out (LIFO) approach of inventory pricing makes the assumption that the costs of the first item sold are the same as the costs of the most recent purchases. In general manufacturing parlance and Inventory management, LIFO also relates to letting go of your most recently produced inventory than the earliest ones. The LIFO approach charges the materials used in a project or process at the cost of the most recent units acquired and applies value to a company’s inventory.

In other words, the Last in First out system charges the price of the most recent lot of materials until the lot is used up. The cost of the subsequent most recent lot is then applied to the task, division, or process. As a result, a used batch of materials is left in hand.

Materials should be handled as the most current stock on hand when they are brought back from the plant to the warehouse. They must be entered at the same price they were when they were given to the manufacturer on the materials ledger card balance found underneath all of the units currently in stock.

Calculating Cost of Goods Sold

The cost of goods sold (COGS) for a firm is calculated through the inventory process at the end of the year and is reported on your business tax return. Your gross profit for the year is calculated by subtracting COGS from your gross income (before costs).

Here’s how COGS are determined:

- inventory count at the beginning of the year

- Including purchases, labor expenditures, and other expenses

- removing inventories at the year’s conclusion.

Lifo Accounting Method

There are various ways to calculate the cost of your inventory when doing the COGS calculation. There are three typical methods for valuing inventory:

- Specific Identification: When you can identify and correlate the goods’ real costs to their costs, specific identification is employed for certain types of inventory (for example, a car using the Vehicle ID Number)

- Last In, First Out (LIFO): This strategy, known as LIFO, is based on the idea that you sell, consume, or dispose of things in the order they were acquired or created.

- First In, First Out (FIFO): The FIFO technique assumes that the goods you as the business owner bought or created first are the goods you sell, eat, or discard.

If you use the Last in first out cost method, you may then use one of the IRS-approved grouping criteria to make it simpler to count the items. Two of these guidelines for Last in First Out valuation are:

- The dollar-value technique divides items and goods into groups based on the kind of products they are.

- the condensed dollar-value approach, with several inventory types grouped into broad groups

An Example of LIFO Calculation – LIFO Conformity Rule

Assume a product is made in three batches during the year. The costs and quantity of each batch (in order of when they are produced) are as follows:

- Batch 1: Quantity 2,000 pieces, cost to produce $8,000

- Batch 2: Quantity 1,500 pieces, cost to produce $7,000

- Batch 3: Quantity 1,700 pieces, cost to produce $7,700

Total produced: 5,200 pieces. Total cost: $22,700. The average cost to produce one piece: is $4.37.

Next, calculate the unit costs for each batch produced.

- Batch 1: $8,000/2,000 = $4

- Batch 2: $7,000/1,500 = $4.67

- Batch 3: $7,700/1,700 = $4.53

To determine the cost of units sold, under Last In First Out accounting, you start with the assumption that you have sold the most recent (last items) produced first and work backward.

Let’s say 4,000 units were sold during the year. Using Last In First Out, you assume that Batch 3 items were sold first. Thus, the first 1,700 units sold from the last batch cost $4.53 per unit. That’s a total of $7,701.

- The next 1,500 units sold from Batch 2 cost $4.67 per unit, for a total of $7,005.

- And the last 800 units sold from Batch 1 cost $4 each, for a total of $3,200.

- The total cost of the 4000 items sold is $17,906.

The cost of the remaining 1200 units from the first batch is $4 each for a total of $4,800. These units will start off the next year. This helps in determining the LIFO cost flow assumption

advantages of lifo

The following are the main advantages of the Last In First Out method of inventory valuation:

- The most current cost is applied to the production.

- The factory receives materials that are methodically priced.

- Closing inventory losses are kept to a minimum when there is a significant change in the materials

Disadvantages of LIFO

The Last In First Out method of inventory valuation suffers from the following major drawbacks:

- The closing inventory value may differ from the current market value

- It may be challenging to keep records when several purchases of the same material are made at different prices

- Costing difficulties arise when materials are returned to the vendor

- Costing difficulties arise when materials are returned from the factory to the storeroom

When to use LIFO manufacturing

Last In First Out isn’t a method of production; it’s a method of accounting. Therefore, you don’t use LIFO in order to manufacture a product or service you use Last In First Out to track your inventory during the production process. You might want to use Last In First Out for a production run if you have multiple products/batches being manufactured at the same time. LIFO is often used to track goods when there are large, different batches or lots being manufactured.

For example, if your production facility makes several different kinds of aircraft, each with a small batch of parts, you might want to track each batch separately. If your plant manufactures a range of different products, such as electronics, the same concept could apply. If you have several different batches of materials being processed at the same time, you may want to track them separately using LIFO. LIFO methods are generally used in industries with high volumes of materials that are similar but made at different times and/or in different locations.

They are also used in industries where the most recent inventories are desired by the customer and the manufacturing units have no option but to cater to the customer demand.

How LIFO works in manufacturing

LIFO is a way of tracking materials as they move from raw materials to semi-finished goods, to finished goods. When a batch of goods is completed, all of the inventory associated with that batch is first transferred to the next stage of the process. That means that the inventory that was last to be processed (shipped to a customer or placed in a warehouse) is the first inventory that is processed in the next batch.

In order to use LIFO, you have to have control of each batch of goods. You need to know what batch each batch belongs to. You also need to know the number of goods in each batch. When you’re using LIFO, you track the inventory in batches. A batch is a batch of goods that was acquired and processed at the same time. For example, if you bought 100 units of a certain component and processed them all at the same time, they would go into the same batch.

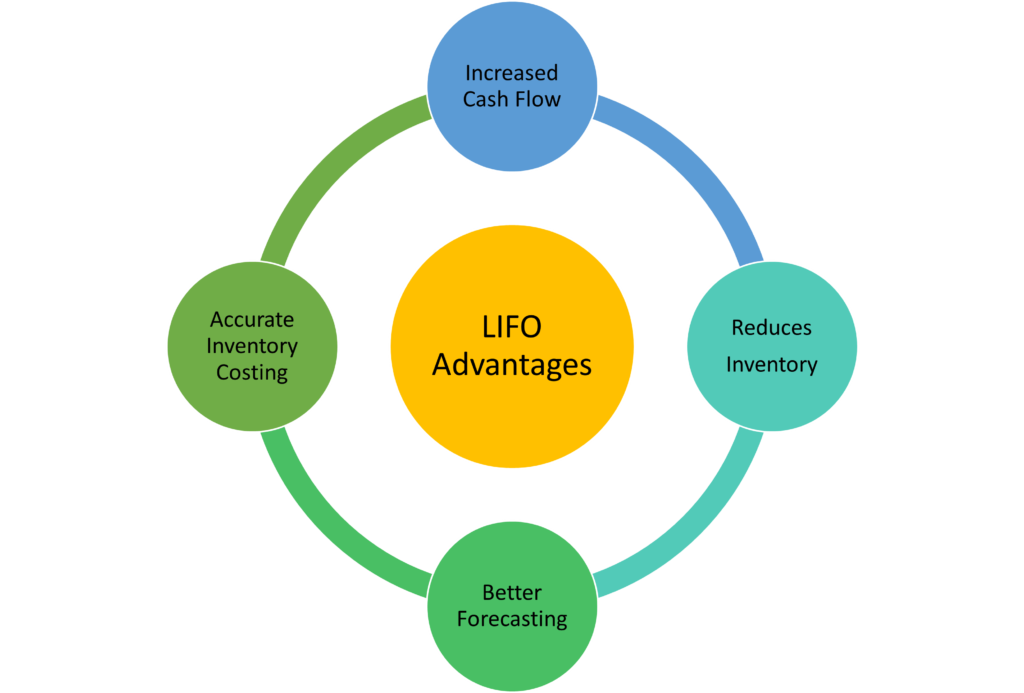

LIFO Benefits in Manufacturing

- Increases cash flow: If you use LIFO inventory accounting, you have less inventory on hand and therefore less money tied up in inventory. That means your cash flow increases as a result.

- Reduces inventory: Using LIFO inventory accounting means there is less money tied up in inventory. With less money tied up in inventory, businesses have more capital available to purchase goods.

- More accurate inventory costing: Using LIFO inventory accounting means the most recent goods purchased are the first goods put on the books. That means those goods are more likely to be more accurate in terms of the cost associated with them.

- Better forecasting: When using LIFO inventory accounting, businesses have a more accurate picture of the cost of goods. That means businesses will be better able to forecast the costs associated with producing goods in the future.

Disadvantages of LIFO Manufacturing

- Higher cost of goods: One drawback of using LIFO inventory accounting is that it will lead to higher costs of goods sold for the current period. That means the company will pay more taxes for the current year.

- Inaccurate inventory valuation: Another drawback to using LIFO inventory accounting is that it can result in inaccurate inventory valuation. That means the number of goods on the books may not match the actual quantities of goods in inventory.

- Effects on cash flow: Using LIFO inventory accounting will result in lower cash flow. That means the company will have less money available to pay for goods.

What does LIFO mean in Software development?

LIFO is a very common technique in software development. A business analyst who compiles data work on a concept called “Product Backlog” when working on an Agile Program Management. This product backlog is generated when the development team fails to deliver previous commitments. However, with new requirements from customers or the Business Analyst, the development team generally tends to prioritize the last gathered inputs. This helps roll out the product backlog in reverse order. This LIFO method of delivery in Agile Project Management is a very important aspect as it helps in delivering the most recent and important features. This also helps in overcoming the rigidity of delivery making the team more flexible in rolling out the features.

Limitations of the LIFO Method

LIFO can help businesses account for the cost of goods sold in earlier tax years and reduce potential audit issues. However, it is not always the best choice for businesses particularly those with inventory that is consistent or changing at a slow pace. The LIFO method can cause businesses to overvalue their inventory. You can see evidence of this in the graph below, which shows a trend of higher inventory values over time compared to FIFO (which is the opposite of LIFO).

This means businesses are overvaluing their inventory and will likely owe more taxes as a result. The graph above shows that, historically, businesses using the LIFO method have overvalued their inventory by an average of 8.5%. This means that businesses that use LIFO will likely owe more taxes as a result, though the amount will vary by each business.

Samrat is a Delhi-based MBA from the Indian Institute of Management. He is a Strategy, AI, and Marketing Enthusiast and passionately writes about core and emerging topics in Management studies. Reach out to his LinkedIn for a discussion or follow his Quora Page