In the spring of 2014, Drugs industry was in a Merger and Acquisition frenzy. The following few years resulted in serious consolidation in the pharmaceutical industry, with bigger firms buying smaller firms. Valeant, a Canadian manufacturer of specialty drugs was ebullient in 4 Quarters of continuous growth resulting in many bigger players like Pfizer looking to acquire Valeant. Valeant specifically undertook an “Asset Stripping” approach in which they would acquire distressed smaller companies and sell their assets and show the books as profits.

However, only two years later they found themselves sitting on a $ 30 Bn debt timebomb that was ready to explode anytime. Investors in Valeant lost billions of dollars and resulting in a fraud investigation by US Securities and exchange commission.

Introduction to Asset Stripping

Asset stripping is the act of selling off the assets of a company, especially in a piecemeal manner, in order to pay off the company’s debts or to benefit the owners or shareholders. It is often done when a company is in financial distress or when it is being acquired by another company. Asset stripping can be used to maximize the value of a company’s assets and minimize its liabilities, but it can also be used to deliberately undermine the company’s financial stability and viability. Asset stripping is generally considered to be a negative practice, as it can lead to job losses and can harm the long-term prospects of the company and its stakeholders.

How is asset stripping generally done?

- A company is facing bankruptcy, and its creditors demand that the company sell off its assets in order to pay off its debts. The company’s assets, such as its factories, equipment, and real estate, are sold off to the highest bidder.

- A company is acquired by another company, and the new owners sell off certain assets, such as real estate or intellectual property, in order to generate cash or to streamline the company’s operations.

- A company is struggling financially, and its shareholders vote to sell off certain assets in order to generate cash or to pay off debts. This can include selling off divisions or subsidiaries of the company or selling off intellectual property or other valuable assets.

- A company is acquired by a private equity firm, which then sells off the company’s assets in a piecemeal manner in order to maximize its return on investment. This can include selling off divisions or subsidiaries of the company or selling off intellectual property or other valuable assets.

asset stripping example

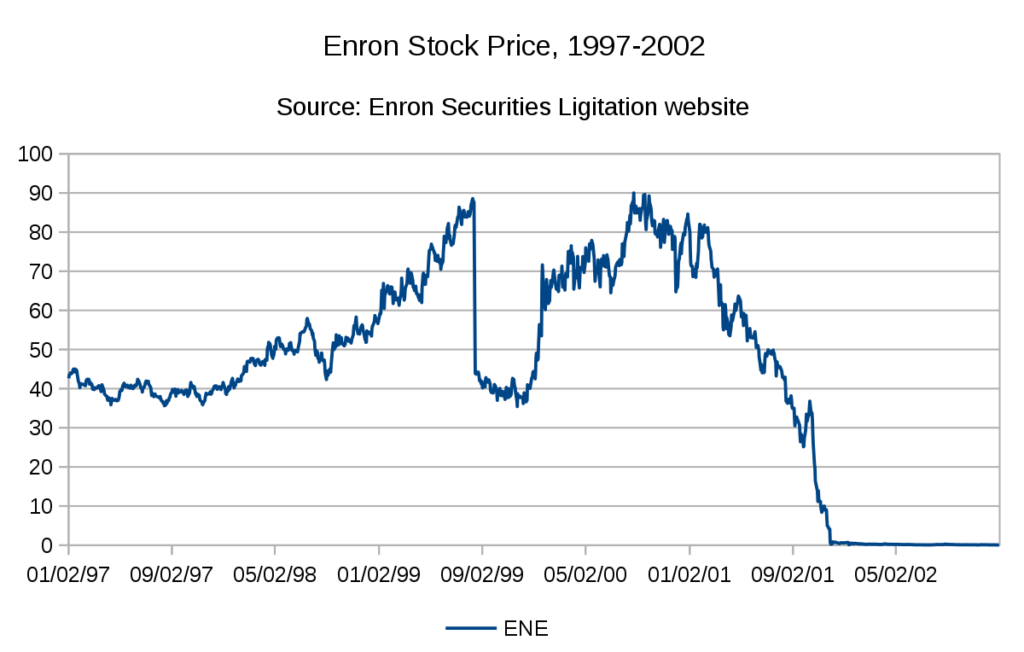

- In 2002, the energy company Enron was found to have engaged in widespread asset stripping in order to hide its financial problems and inflate its stock price. The company sold off many of its assets, including its pipelines and power plants, and used the proceeds to pay off its debts and make it appear as if the company was more profitable than it actually was. Enron’s asset stripping eventually led to the company’s bankruptcy, which resulted in the loss of thousands of jobs and billions of dollars in shareholder value.

- In 2007, the private equity firm Blackstone Group acquired the hotel company Hilton Hotels for $26 billion. Blackstone then sold off many of Hilton’s assets, including its casino and gaming operations, in order to generate cash and pay down debt. Blackstone ultimately sold Hilton for $26.7 billion in 2013, making a profit of $700 million on the sale.

- In 2018, the pharmaceutical company Valeant was accused of asset stripping in order to boost its stock price and meet financial targets. Valeant had acquired many companies and then sold off their assets, including their research and development operations, in order to generate cash and pay down debt. The company’s stock price eventually plummeted, and it faced a number of investigations and lawsuits related to its business practices.

Why is asset stripping considered a Negative Practice?

- It can lead to job losses: When a company’s assets are sold off, it can result in the closure of factories, offices, or other facilities, which can lead to job losses for the employees who work at those locations.

- It can harm the long-term prospects of the company: Asset stripping can undermine the long-term viability and stability of a company by reducing its assets and capabilities. This can make it more difficult for the company to compete and grow in the future.

- It can harm the interests of other stakeholders: Asset stripping can harm the interests of other stakeholders, such as suppliers and customers, who rely on the company for their livelihoods. It can also harm the interests of shareholders, who may see the value of their investment decline as a result of the asset stripping.

- It can harm the reputation of the company: Asset stripping can damage the reputation of a company, as it can be seen as a sign that the company is in financial distress or that it is not acting in the best interests of its stakeholders. This can make it more difficult for the company to attract customers, employees, and investors.

Benefits of Asset stripping

There are a few potential advantages to asset stripping:

- It can generate cash: Asset stripping can generate cash by selling off the assets of a company, which can be used to pay off debts or to fund other business activities.

- It can streamline operations: Asset stripping can involve selling off divisions or subsidiaries of a company that are not central to its core operations. This can help to streamline the company’s operations and focus its resources on its most profitable activities.

- It can maximize the value of a company’s assets: Asset stripping can involve selling off a company’s assets in a piecemeal manner in order to maximize their value. This can benefit the company’s shareholders or owners, who may receive a higher return on their investment as a result.

It’s important to note, however, that the potential advantages of asset stripping are often outweighed by the negative consequences it can have, such as job losses and harm to the long-term prospects of the company.

Who does Asset Stripping?

High Net Worth Individuals

Private Equity induced asset stripping

Sometimes companies also resort to Asset Stripping, buying smaller competitors and selling their assets offs

Samrat is a Delhi-based MBA from the Indian Institute of Management. He is a Strategy, AI, and Marketing Enthusiast and passionately writes about core and emerging topics in Management studies. Reach out to his LinkedIn for a discussion or follow his Quora Page